Under the Unified Trading Account (UTA), the Spot Cost refers to the average cost price of an asset during a calculation cycle. It's a key metric that helps you track your actual Spot trading costs and make more informed trading decisions. This guide explains how Spot Cost is calculated and how you can view or adjust it.

Calculate the Spot Cost

The Spot Cost is calculated as follows:

|

Trades Covered |

Spot Trading, Spot Margin Trading, Convert, and OTC |

|

Calculation Rules |

1. The buy price is converted to USDT for calculation, and the Spot Cost is displayed in USD.

2. Spot Cost will not be calculated for stablecoins or fiat currencies and will appear as "--" on the trading page.

3. Spot Cost is calculated in cycles. It will reset to zero and display as "--" if:

In such cases, the current cycle will end. A new cycle will begin, and the Spot Cost will be recalculated once the asset balance exceeds zero. |

|

Calculation Formula |

Spot Cost = (Original Spot Cost × Original Net Buy Qty. + Last Buy Price × Last Buy Qty.) / (Original Net Buy Qty. + Last Buy Qty. − Trading Fees)

Net Buy Qty. = Buy Qty. − Sell Qty. − Trading Fees |

|

Parameter Adjustment |

1. Spot Cost can be adjusted if the asset balance is greater than 0.

2. Net Buy Qty. can also be adjusted if the asset balance is greater than 0, but it cannot exceed the available asset balance in your account. |

|

P&L |

(Last Price − Spot Cost) × Net Buy Qty |

|

P&L % |

(Last Price − Spot Cost) / Spot Cost |

Notes:

— The calculation considers Spot Trading, Spot Margin Trading, Convert, and OTC Trading data available on our platform since the Spot Cost feature was launched on 12 Feb 2025.

— Deposits, transfers, and withdrawals do not affect Spot Cost. However, if the asset balance falls below the Net Buy Qty., the Net Buy Qty. will adjust to match the asset balance, which may impact the P&L.

— The Net Buy Qty. represents the total within a given calculation cycle.

— The data provided is for reference only and does not guarantee absolute accuracy.

Example

Let’s take BTC as an example to illustrate how Spot Cost changes with different trades. Assume Alice starts with no BTC in her account.

|

Trade |

Scenario |

BTC Balance |

Net Buy Qty. |

Spot Cost (USD) |

Notes |

|

Deposit |

Alice deposits 10 BTC into her account. |

10 |

0 |

0 |

Deposits are not included in the calculations. |

|

Spot Trading |

Alice buys 1 BTC with 70,000 USDT using the BTC/USDT pair. |

10.999 |

0.999

= 1 − 0.001 (0.1% fee) |

70,070.07

= 70,000 X 1 / 0.999 |

Net Buy Qty.

= Buy Qty.− Sell Qty. − Trading Fees |

|

OTC Trading |

Alice sells 1 BTC for 80,000 USDT via OTC Trading. |

9.999 |

0 |

0 |

1) The Net Buy Qty. is set to 0 if the actual Net Buy Qty. < 0.

2) The Spot Cost resets to 0, and the current calculation cycle ends. |

|

Convert |

Alice converts 90,000 USDT into 1 BTC via Convert. |

10.999 |

1 |

90,000 |

1) A new calculation cycle begins.

2) No trading fees are charged for exchanges made via Convert. |

|

OTC Trading |

Alice buys 1 BTC with 30 ETH using the BTC/ETH pair. |

11.999 |

2 |

94,500

= (90,000 X 1 + 99,000 X 1) / (1 + 1) |

1) The buy price of 30 ETH is converted to 99,000 USDT (30 x 3,300).

2) No trading fees are charged for OTC trades. |

|

Transfer Out |

Alice transfers 1 BTC from her UTA to her Funding Account. |

10.999 |

2 |

94,500 |

Transfers do not affect the Spot Cost as long as the asset balance remains > 0. |

|

Transfer Out |

Alice transfers 10 BTC from her UTA to her Funding Account. |

0.999 |

0.999 |

94,500 |

If the asset balance falls below the Net Buy Qty., the Net Buy Qty. will adjust to match the asset balance. |

|

Spot Margin Trading |

Alice sells 2 BTC using the BTC/USDT pair through Spot Margin Trading. |

-1.001 |

0 |

0 |

1) The Spot Cost resets to 0 because the asset balance falls below 0.

2) The current calculation cycle ends. |

|

Convert |

Alice converts 400,000 USDT into 4 BTC via Convert. |

2.999

= 4 − 1.001 |

2.999 |

100,000 |

No trading fees are charged for exchanges made via Convert. |

View the Spot Cost

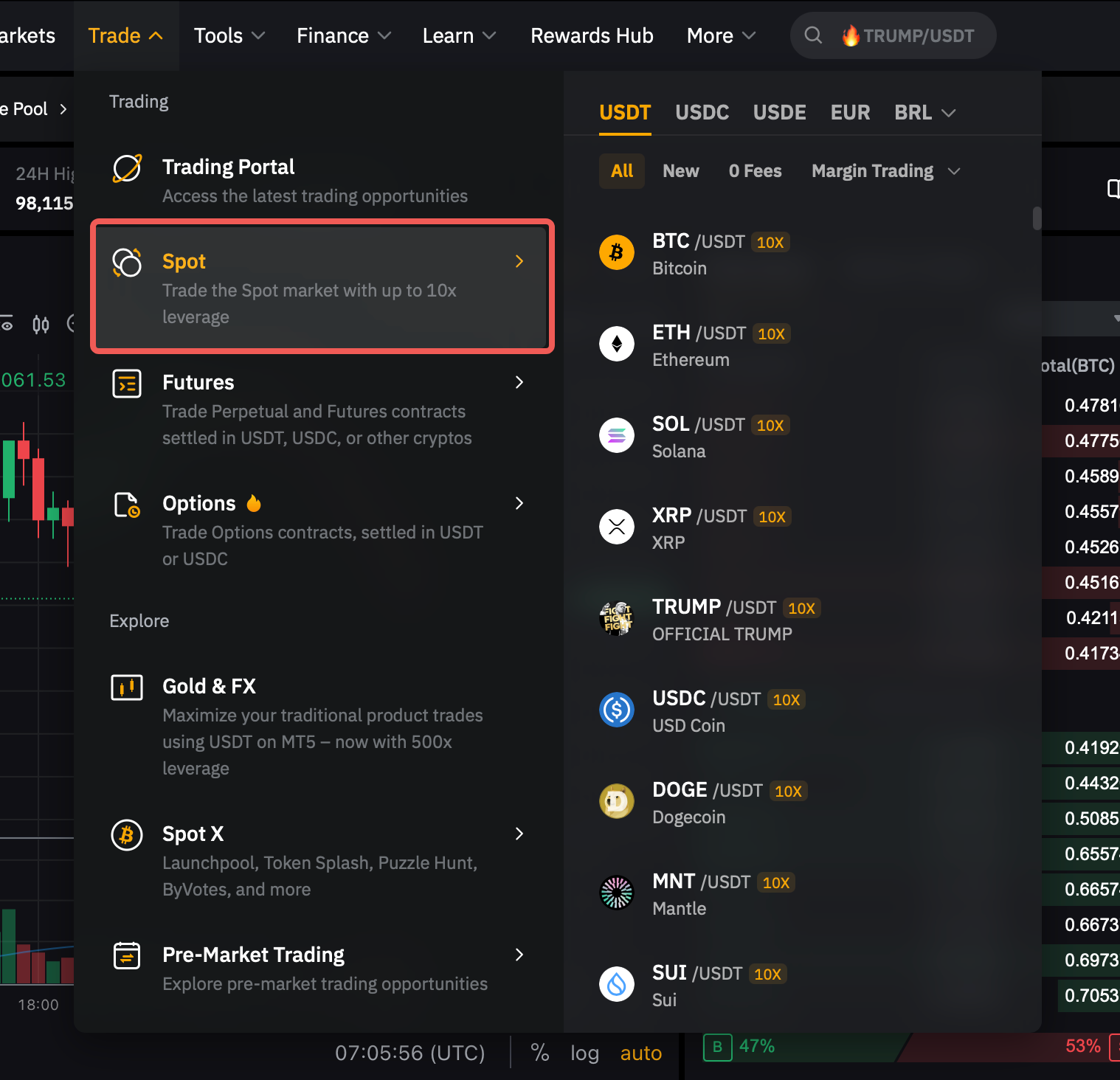

Step 1: Log into your account and click Trade → Spot in the top navigation bar to access the Spot trading page.

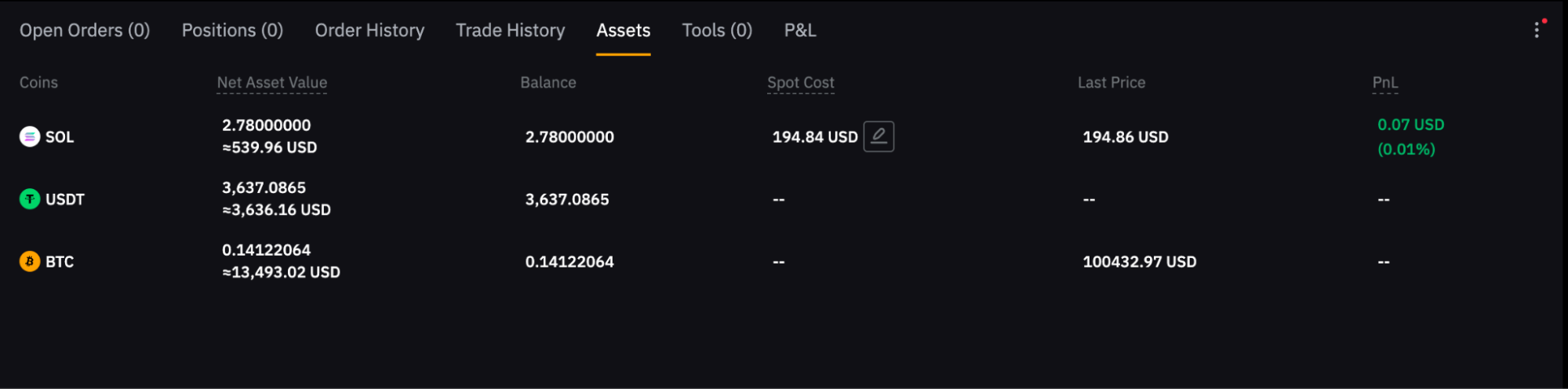

Step 2: Scroll to the bottom and click Assets to view your Spot Cost.

Adjust the Spot Cost

Bybit calculates the Spot Cost using data collected on our platform since 12 Feb 2025. If the displayed cost doesn't match your actual cost, you can adjust it manually.

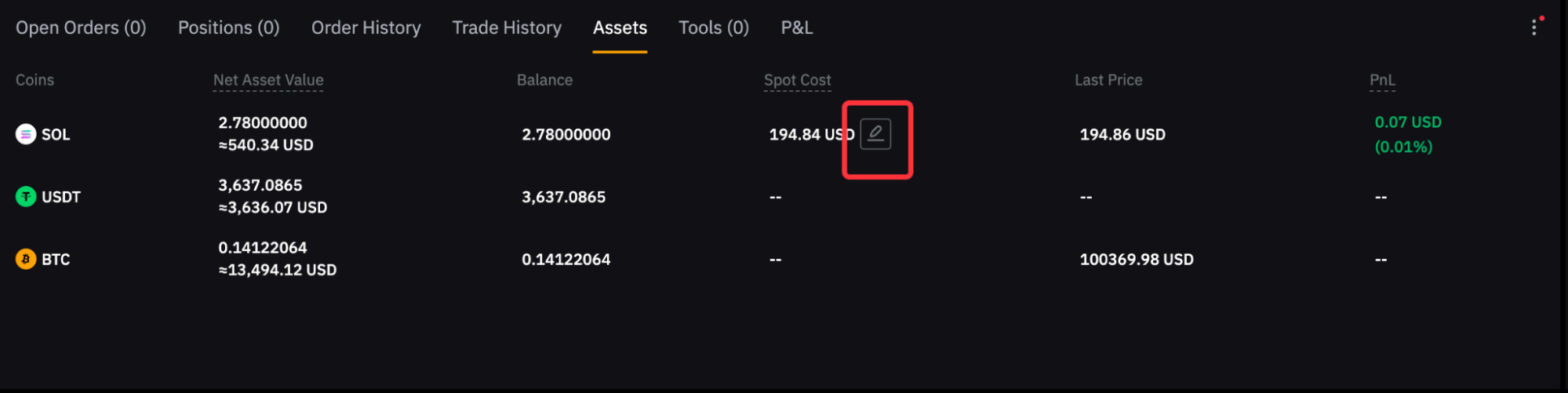

Step 1: Scroll to Assets at the bottom of the page and click the edit icon next to the displayed Spot Cost value.

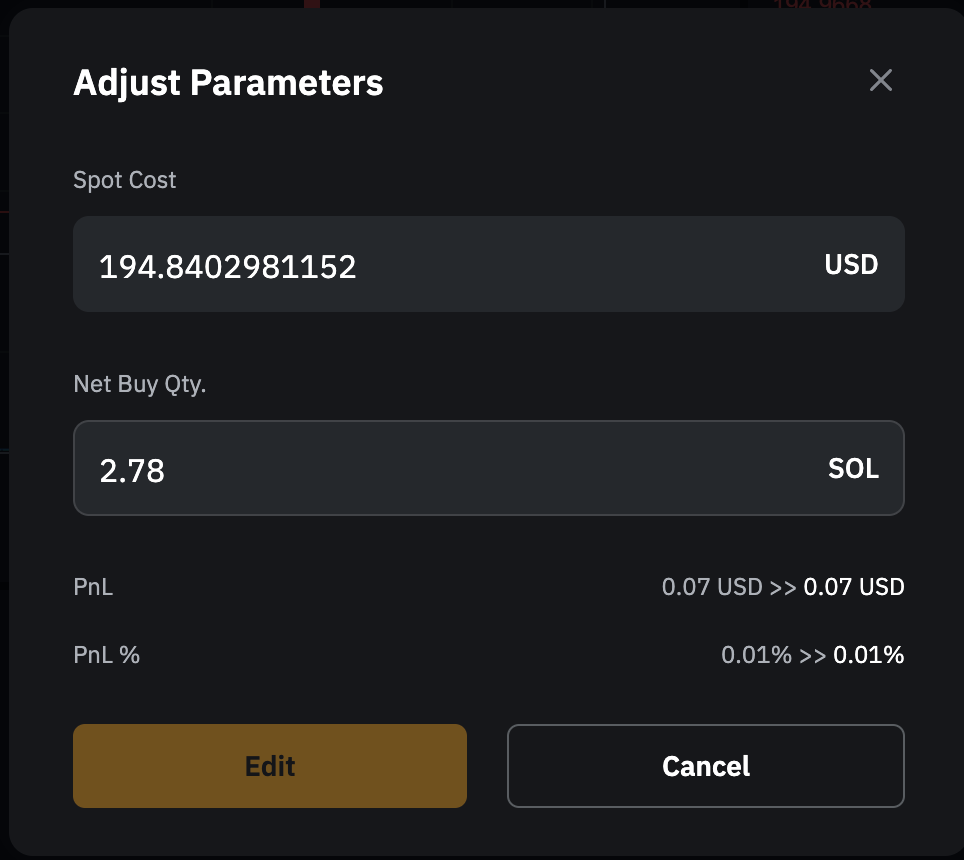

Step 2: In the Adjust Parameters pop-up, enter your new cost. You can also update the Net Buy Qty. if needed. Click Edit to save your changes or Cancel to discard them.

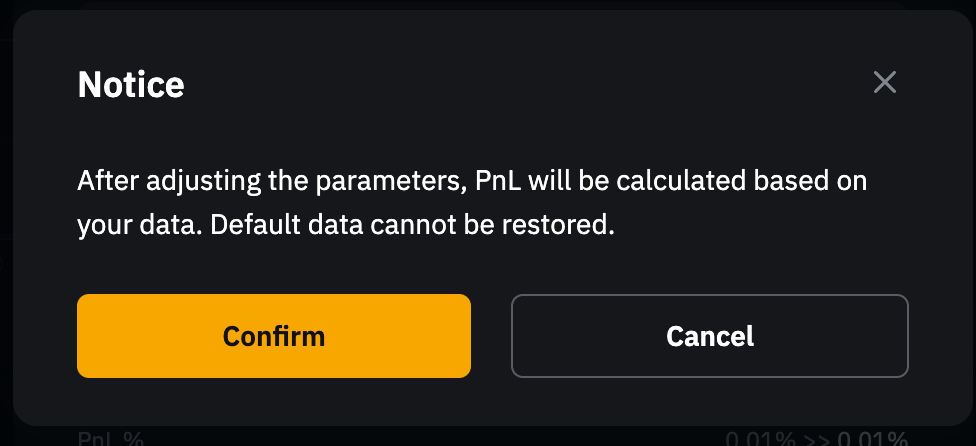

Step 3: A confirmation pop-up will notify you that the P&L and P&L % will be recalculated based on the updated data. You can view the updated P&L and P&L % under P&L, located next to Assets at the bottom of the trading page. Please note that adjustments are irreversible. To proceed, click Confirm.

Step 4: Once the change is successful, you'll see a confirmation message. Your Spot Cost has now been successfully adjusted!

Notes:

— The base and quote currencies of a trading pair, such as BTC (Base) and USDC (Quote) for BTC/USDC, are always displayed regardless of balance.

— Tokens valued below 0.0001 BTC are excluded, so if BTC is priced at $82,017.29, only tokens worth more than $8.20 are displayed.

— Tokens are sorted from highest to lowest USD value after showing the base and quote currencies.

— The amount entered in Net Buy Qty. cannot exceed the available asset balance in your account.

— Adjustments are only possible if the asset balance is greater than zero.

— You can input values with up to 18 decimal places in Spot Cost. When displayed, values with a whole number will be shown with up to two decimal places, while values without a whole number will show up to four significant digits. For example, 1234.00000001 will display as 1234.00, while 0.000001235000 will be shown as 0.000001235.