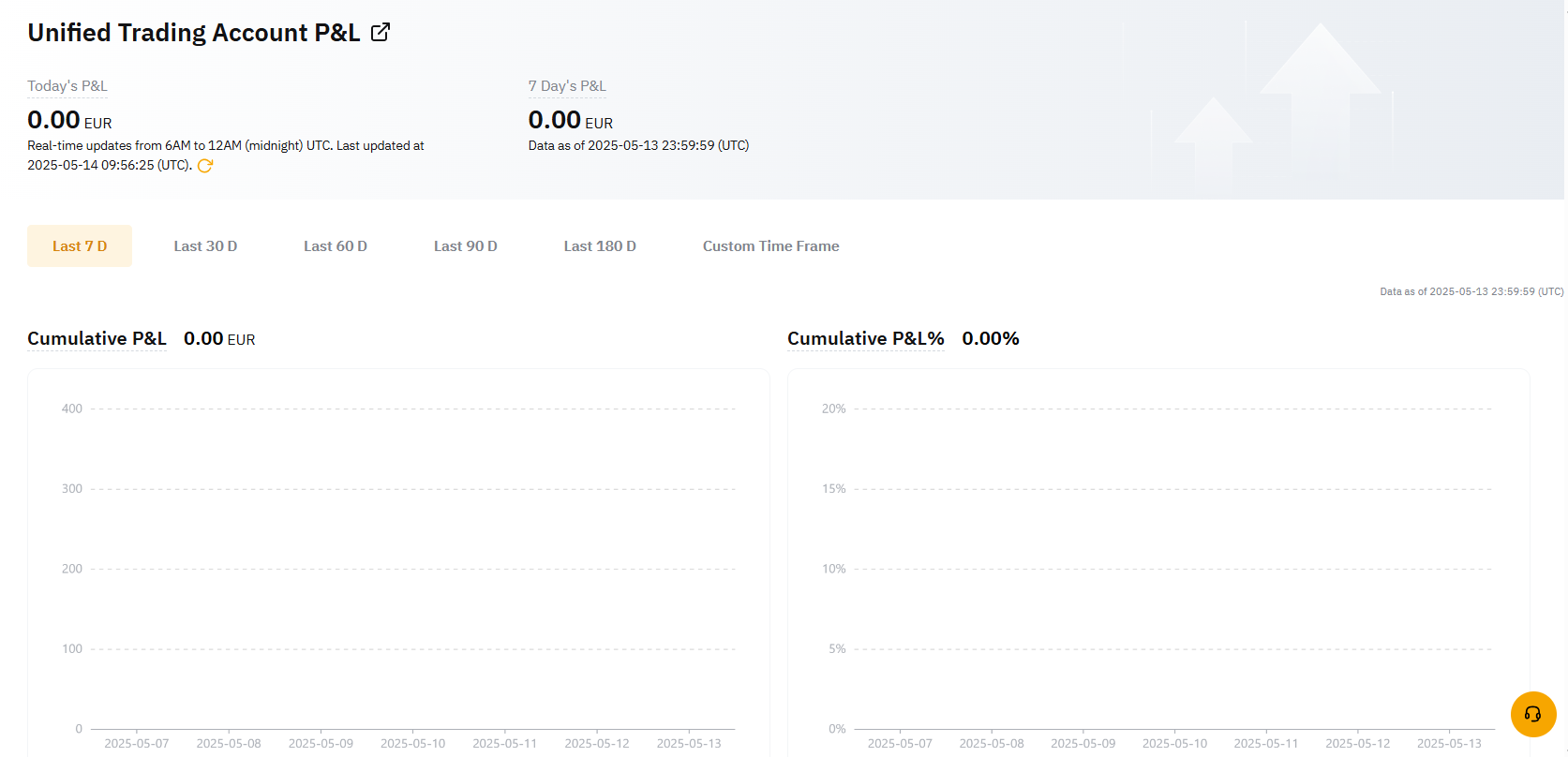

The Account P&L analysis is introduced to help users understand the profit and loss analysis of their crypto holdings and visualize their performances over a selected period.

Unified Trading Account P&L Analysis

|

Metrics |

Calculation |

|

Today’s P&L |

Today’s P&L = Current Total Equity - Initial Equity at 12AM UTC Today - Total Asset Inflow + Total Asset Outflow Since 12 AM Today) |

|

7-Day‘s P&L |

7-Day P&L = Current Total Equity - Initial Equity on Day 1 - Total Asset Inflow + Total Asset Outflow) |

|

Cumulative P&L |

Cumulative P&L for a specific period = Total Equity at the end of the period - Total Equity at the start of the period - Total Asset Inflow + Total Asset Outflow) |

|

Cumulative P&L (%) |

Cumulative P&L (%) for a specific period = (Total Equity at the end of the period - Initial Equity at the start of the period - Net Asset Inflow during the period) / (Initial Equity at the start of the period + Total Asset Inflow during the period) Net Assets Inflow = Total Asset Inflow - Total Assets Outflow during the period |

|

Daily P&L |

Daily P&L = Total Equity at 11:59 PM UTC - Initial Equity at 12 AM UTC - (Total Asset Inflow - Total Asset Outflow) |

|

Daily P&L Details |

A list of Daily P&L in chronological order that can be exported. |

Example

At T+0, the index price of BTC is 43,000 USDT, and ETH is 2,400 USDT. Trader A’s total holdings in his Unified Trading Account are 1 BTC and 1 ETH.

At T+1, the index price of BTC increases to 45,000 USDT, and ETH to 3,000 USDT. He opened a BTCUSDT position and had a realized loss of 10 USDT and an unrealized loss of 200 USDT. On the same day, Trader A withdraws 0.5 BTC and 1 ETH from the UTA.

Trader A’s Account P&L is as follows:

At T+0, Total Equity = 1 × 43,000 + 1 × 2,400 = 45,400 USDT

At T+1, Total Equity = (0.5 × 45,000 - 10 - 200) = 22,290 USDT

Net Inflow = 0

Net Outflow = (0.5 x 45,000 + 1 × 3,000) = 25,500 USDT

Today’s P&L = 22,290 - 45,400 + 25,500 = 2,390 USDT

Cumulative P&L = -10 + 13,990 = 13,980 USDT

Cumulative P&L% = (24,980 - 10,000 - 1,000) / (10,000 + 1,000) × 100% = 127.09%

How to Access Unified Trading Account P&L Analysis

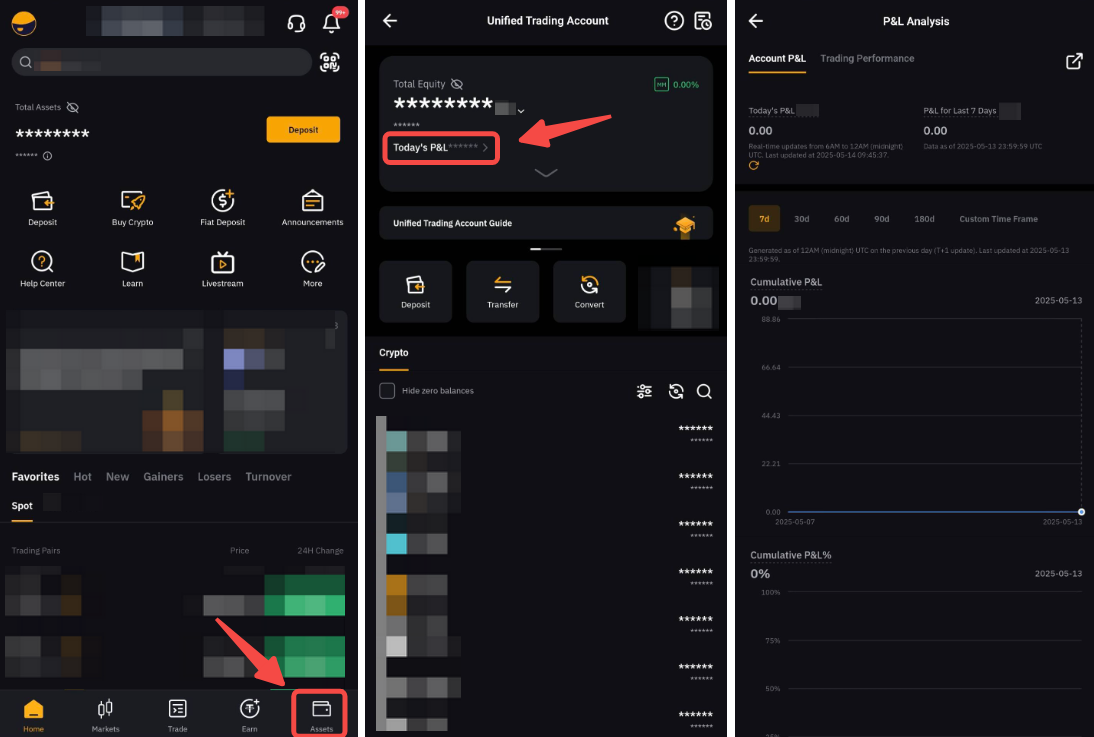

On the App, go to your Unified Trading Account asset page and tap on your Today’s P&L.

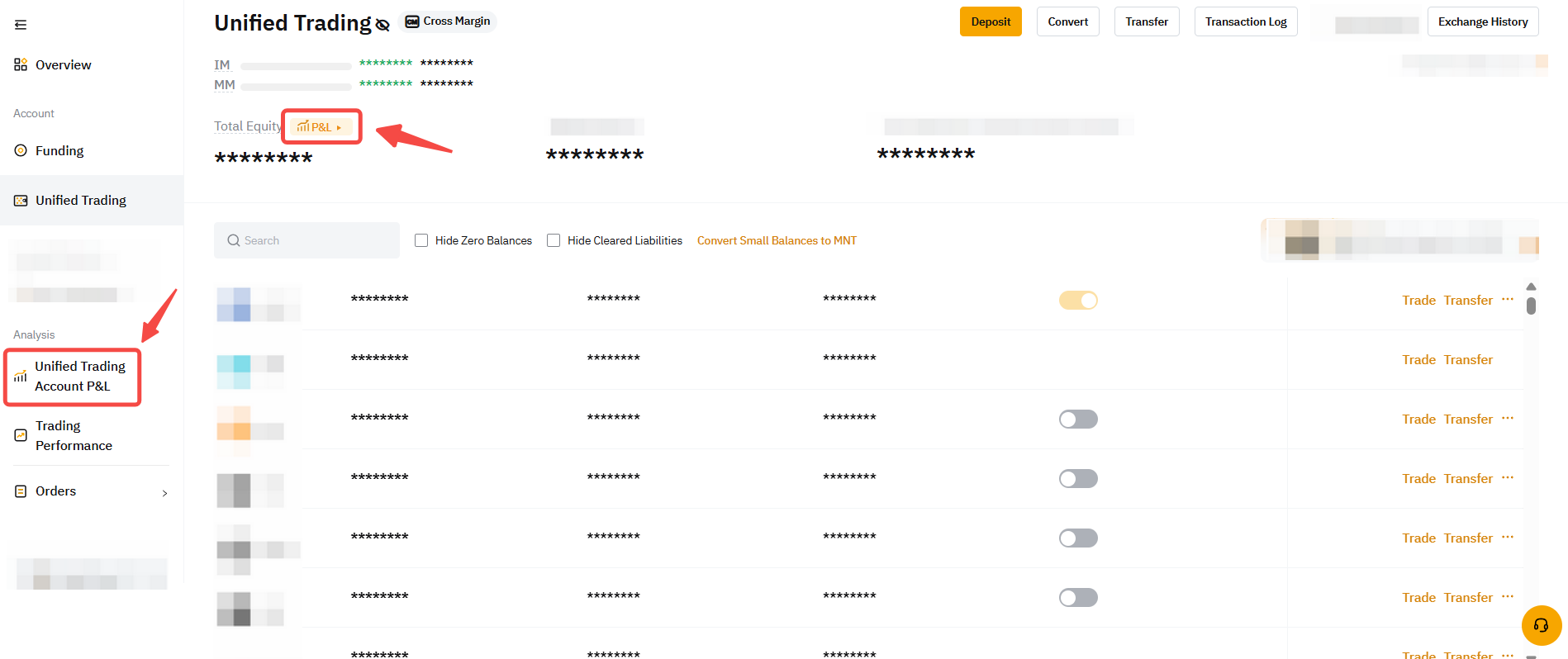

On the Website, you can go to your Unified Trading Asset Page and click on the Unified Trading Account P&L page.