- Deposit Fee

- Withdrawal Fee

- Fiat Deposit Fee

- Fiat Withdrawal Fee

- Trading Fee

- Funding Fee

- Liquidation Fee

- Interest

- Other Fees

1. Deposit Fee

|

On-Chain Deposit & Internal Transfer |

There are no fees charged on Bybit for internal transfers or on-chain crypto deposits into your Bybit Account.

Read More: Crypto Deposit FAQ |

|

Buy Crypto |

Transaction fees will be charged by our service provider depending on the currency and the payment method used. You will be able to see the fees required on the order page.

Read more: Buy Crypto FAQ

For P2P Trading, Bybit offers zero transaction fees for either the buyer or seller. However, traders may need to pay transaction fees to the payment provider based on the payment method selected.

Read more: P2P Trading FAQ |

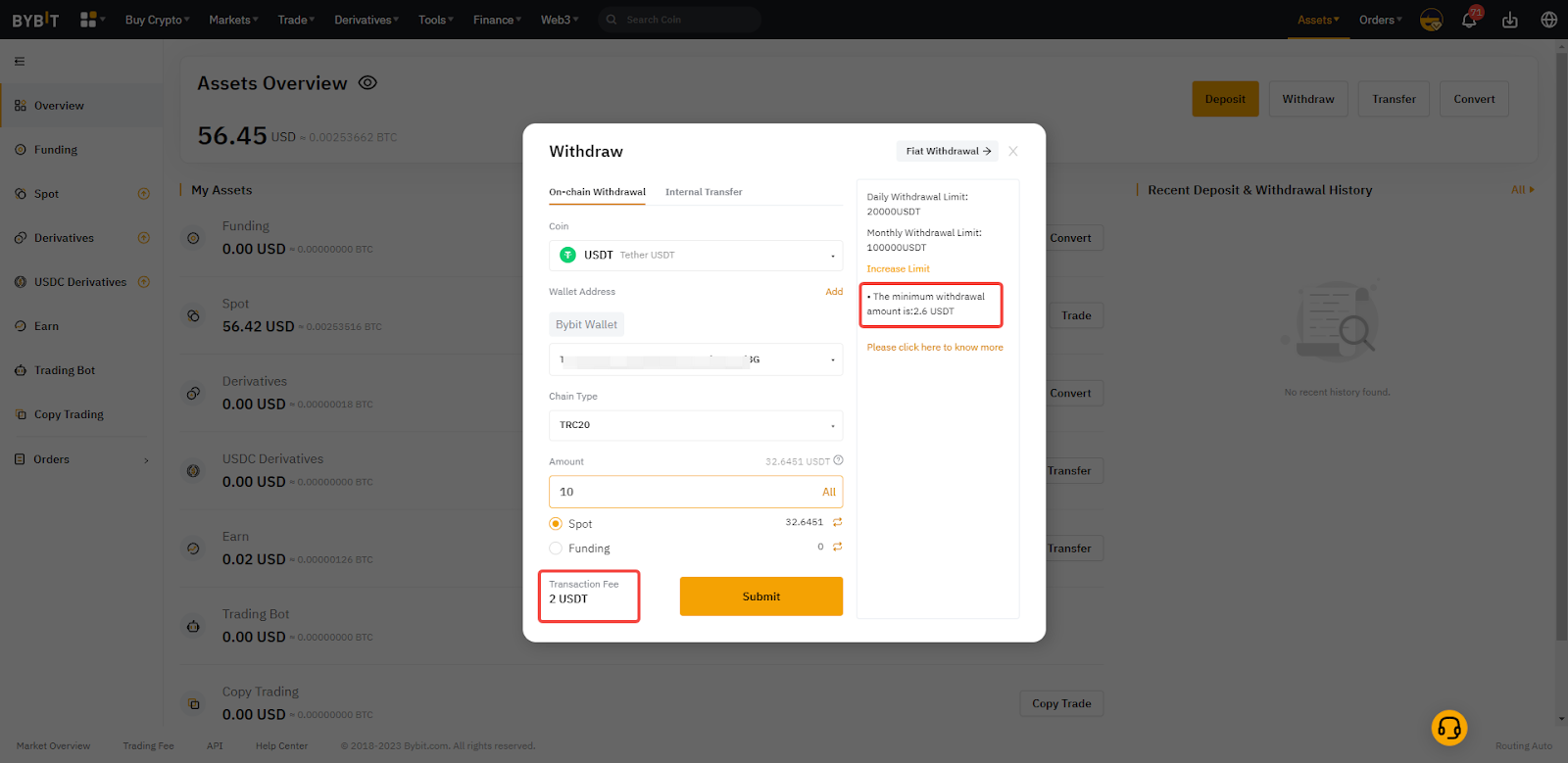

2. Withdrawal Fee

A Withdrawal Fee will be charged for on-chain withdrawal depending on the different coins and chains selected. You can see the minimum withdrawal amount and withdrawal fees stated on the withdrawal window. Please note that the withdrawal fee is fixed for any withdrawal amount.

No withdrawal fee will be charged for Internal Transfers to other Bybit Account.

Read more: Withdrawal FAQ

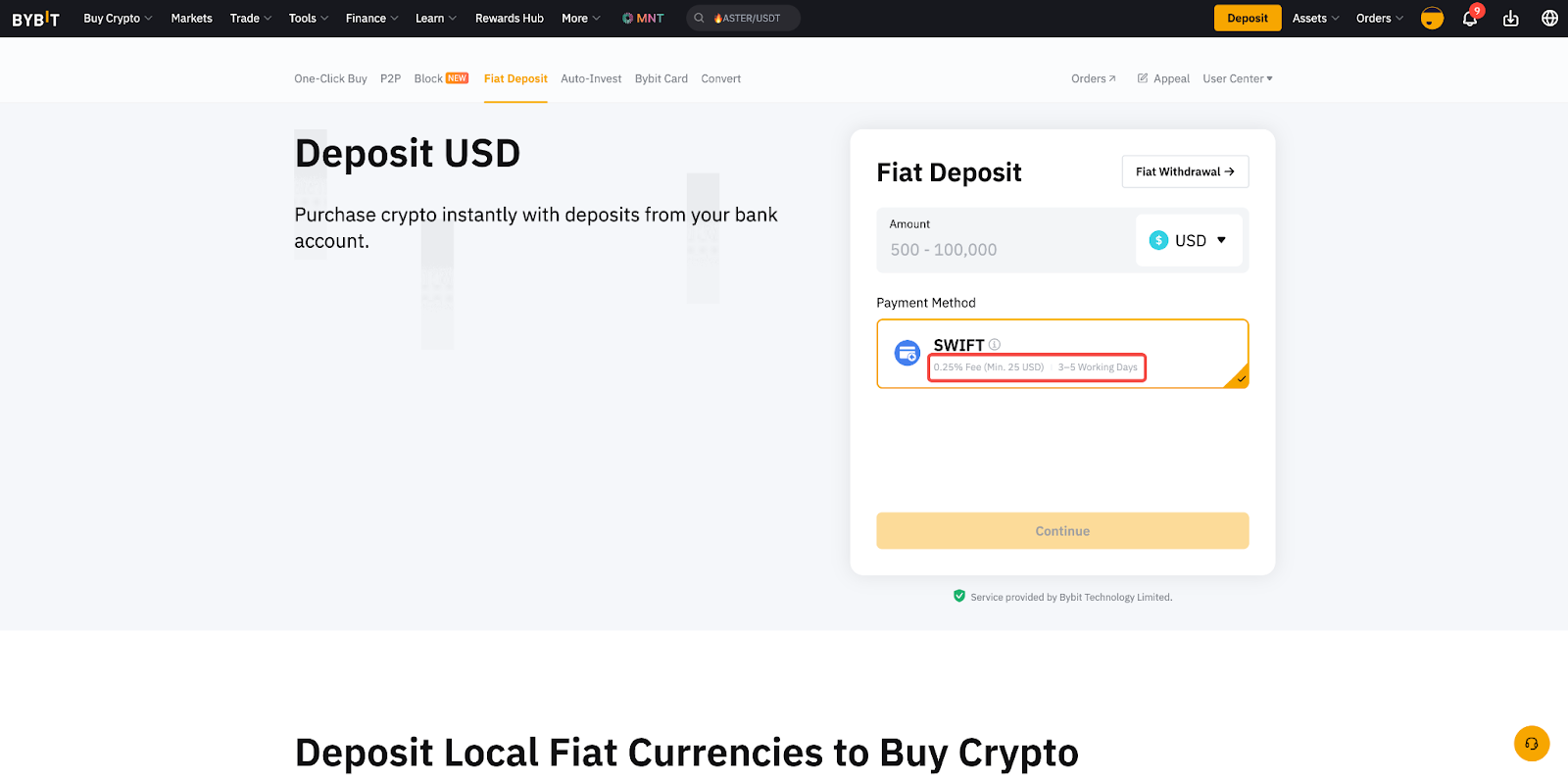

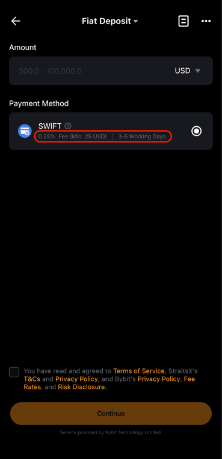

3. Fiat Deposit Fee

There may be fees associated with your fiat deposit depending on the selected fiat currency and payment method. You can view the applicable fee rates for each fiat currency and payment method by visiting the Fiat Deposit page and selecting your desired currency.

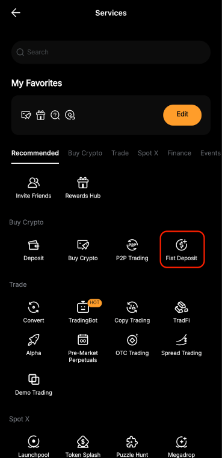

On the App, please go to the Homepage and tap More, then select Fiat Deposit. Next, tap on the fiat currency to view the associated fees for each available payment method.

Note:

– Available payment methods vary depending on your country or region of residence and the availability of service providers. You may refer to this article for the list of restricted regions.

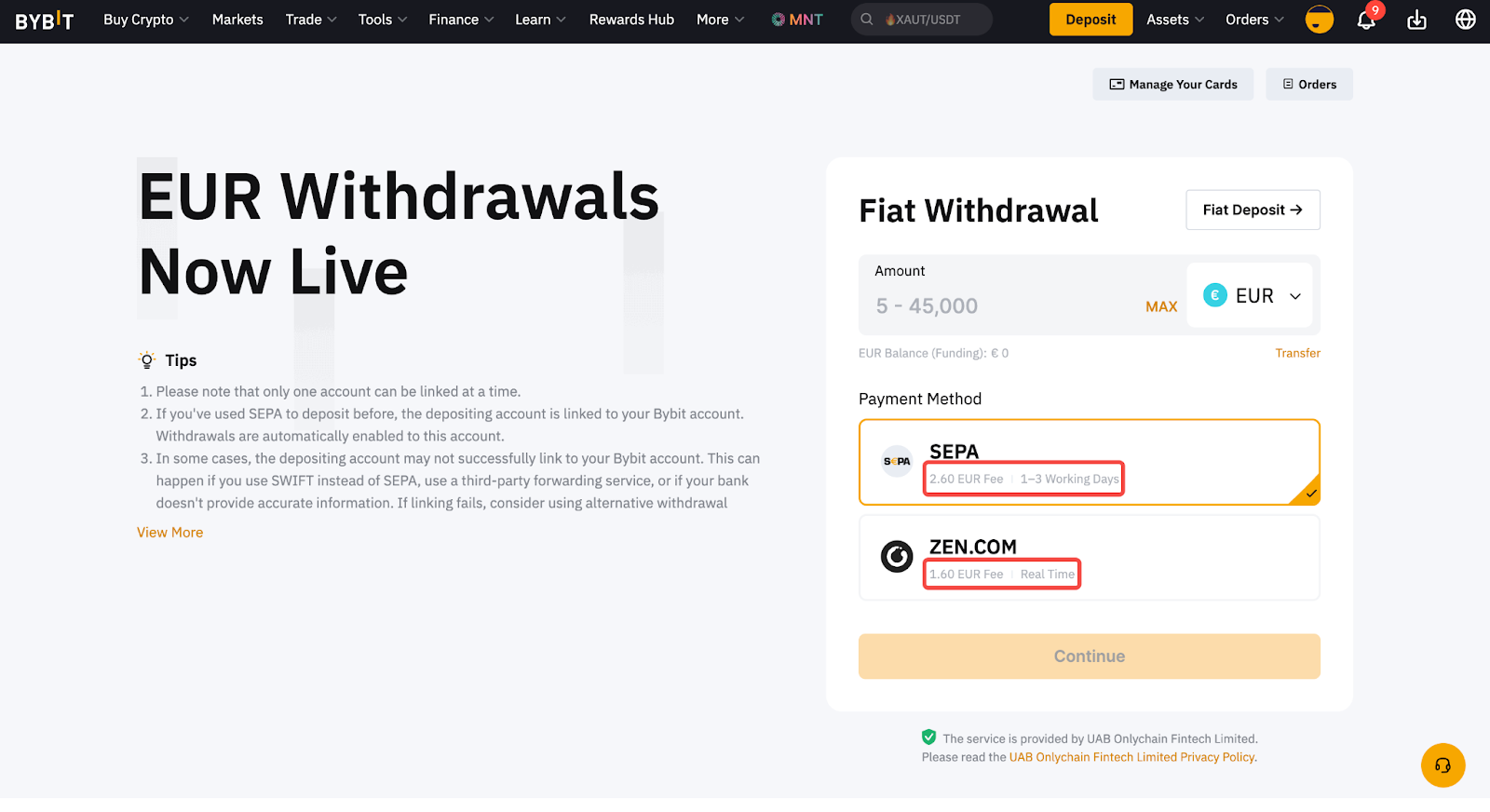

4. Fiat Withdrawal Fee

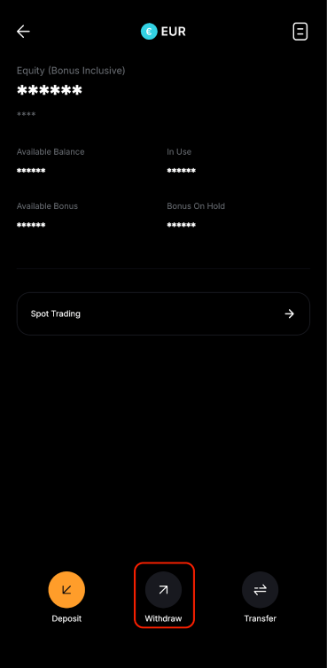

There may be fees associated with your fiat withdrawal depending on the selected fiat currency and payment method. You can view the applicable fee rates for each fiat currency and payment method by visiting the Fiat Withdrawal page and selecting your desired currency.

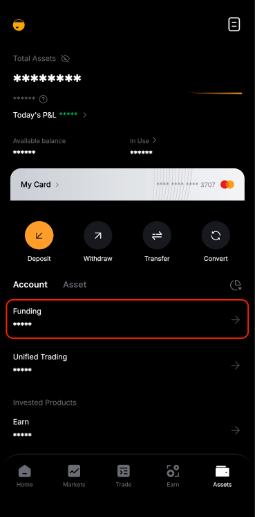

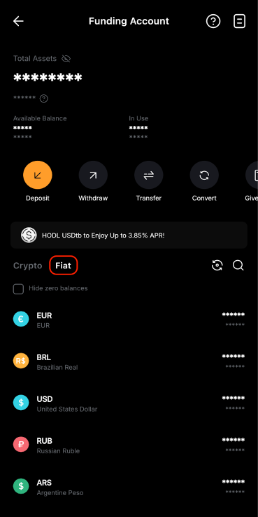

On the App, please go to the Assets page and tap Funding → Fiat. Then, tap on the Fiat currency and refer to the associated fees for each payment method.

5. Trading Fee

A Trading Fee will be charged for Spot Trading and Derivatives Trading based on the filled order quantity or position value. The rate for Takers and Makers is different and you will be entitled to a lower fee rate according to your VIP level.

This table below shows the fee rates for Non-VIP users:

|

Spot Trading |

Taker Fee Rate: 0.1% Maker Fee Rate: 0.1% |

|

Perpetual & Futures Trading |

Taker Fee Rate: 0.06% Maker Fee Rate: 0.01% |

|

Options Trading |

Taker Fee Rate: 0.03% Maker Fee Rate: 0.03% |

Read More: Bybit Trading Fee Structure

6. Funding Fee

The Funding Fee is the periodic payments and income that are made between traders who hold positions in Perpetual contracts.

In order to anchor the Perpetual contract trading price to the Spot price, the funding mechanism is used to ensure Bybit’s last traded price is always anchored to global standard Spot prices. Here’s a brief overview of how it works: if the Perpetual market price sits above the Spot price (i.e., the funding rate is positive), long position holders will pay the funding fees to short position holders. This incentivizes traders to open more short positions and brings down trading prices, shifting toward the Spot price.

Let's say the Perpetual trading price is lower than the Spot price (i.e. the funding rate is negative). In this case, short position holders will pay the funding fees to long position holders, so that the latter is placed in the driver’s seat to open more positions. Thus, prices are driven up, achieving a similar objective to narrowing the spread.

The funding fee will be charged every few hours, depends on the funding interval of each symbols, based on your position value. You can view the funding rate from the trading page.

Read More:

7. Liquidation Fee

A Liquidation Fee will be charged in the event of liquidation in Spot Margin Trading, Crypto Loan and Options.

In Spot Margin Trading and Crypto Loan, when the loan-to-value (LTV) ratio exceeds the liquidation level, auto repayment will be triggered, and your margin assets will be liquidated to repay the liabilities. A liquidation fee will be charged on top of your liquidated assets and this will be injected to the margin insurance pool.

In the event where your account goes bankrupt, i.e., when you are liquidated and you have insufficient margin assets to repay the liabilities, the platform will use the margin insurance fund to cover the deficit. For more information, please visit here.

For Options trading, liquidation will be triggered when the Account Maintenance Margin Rate reaches 100% and a liquidation fee will be charged. Please refer here for more information.

Bybit does not charge a liquidation fee for Perpetual and Futures Trading.

|

Liquidation Fee Rate | |

|

Spot Margin Trading, Crypto Loan |

2% |

|

Options |

0.2% |

Read More:

What Is Crypto Liquidation & How Do I Avoid It?

LTV and Liquidation (Spot Margin Trading)

Loan-to-Value Ratio and Liquidation (Crypto Loans)

8. Interest

For any borrowing from any of the lending services provided on Bybit, hourly interest will be incurred. This includes Spot Margin Trading, Crypto Loan, Unified Trading Account and others.

You can view the interest rates charged from the respective product page.