Bybit Card is a Mastercard debit card that allows you to access your funds easily and securely wherever and whenever, making it the ultimate companion on your crypto journey.

A reliable and convenient way to off-ramp your crypto and spend on the go, Bybit Card helps you to maximize and fully integrate crypto into your daily life — you can unlock immediate access to online and overseas transactions.

You can use your earnings from Bybit's full suite of trading products and pay for your purchases instantly.

Benefits

-

Accepted by over 90 million Mastercard merchants worldwide

-

Multiple crypto assets as payment options

-

EMV 3-D Secure protects your funds

-

Exciting Loyalty Rewards Program

-

24/7 multilingual Customer Support

How Bybit Card Works

The currencies in the Bybit Card are composed of 1 fiat currency and 3 crypto assets. The fiat currency assigned to your Bybit Card depends on the country of your Advanced Identity Verification. For example, if the country corresponding to your Identity Verification is Germany, then your Bybit Card will be denominated in EUR, and EUR will be deducted from your Funding Account. If there is not enough EUR for the transaction, crypto will be used to cover the remaining balance.

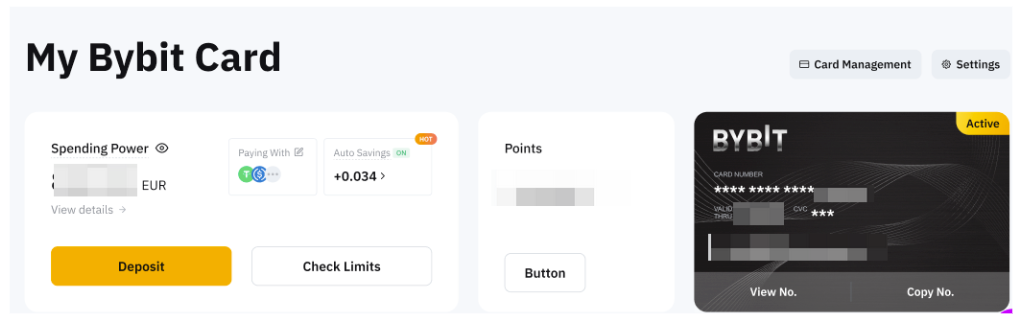

For the crypto used, you can select your preferred payment crypto for your Bybit Card transactions on the My Bybit Card page. Currently, supported cryptocurrencies are BTC, ETH, XRP, USDT, USDC & TON. You can make a purchase using your Bybit Card, the system will follow the payment priority you've set. Please refer to this FAQ to learn how to manage your spending currencies.

During the transaction, the fiat in your Funding Account will be deducted first, and when the amount of fiat is insufficient, the crypto as the payment option will be deducted. Please note that the crypto will be automatically liquidated based on the Bybit One-Click Sell exchange rate plus a 0.9% Bybit Card crypto conversion fee if there is insufficient fiat for the transaction. To learn more about fees, please visit here.

Bybit Virtual and Physical Card

We support both virtual and physical Bybit Cards. With a Virtual Bybit Card, you can make online payments once you have applied successfully, while a physical Bybit Card allows you to make online payments as well as contactless payments in retail stores using POS terminals that support contactless payments.

Bybit also introduced Bybit Virtual Card Lite, a specialized sub-product facilitating swift entry into the Bybit Card ecosystem, eliminating the requirement to complete the Proof-of-Address procedure. As the Virtual Card Lite has a lifetime spending limit of 150 EUR, you have the flexibility to upgrade to the Standard Bybit Virtual Card at any time by fulfilling the Proof-of-Address requirement.

Explore the activation process of Bybit Card and gain insights into its transaction mechanisms by referring to the following articles: