Risk Warning

Why did I receive the Risk Warning pop-up message?

The Risk Warning pop-up is a safety measure to safeguard your account from potential digital threats. It may be triggered when the system detects security risks or unusual activity on your account or transactions.

Receiving the Risk Warning message repeatedly indicates that further investigation is required to ensure the safety and integrity of your account. This standard precautionary measure is taken to safeguard you from potential threats. Hence, it is recommended that you submit the requested document for our team to review.

How can I protect my account from getting a Risk Warning?

Here are some suggestions to safeguard your account and prevent further “Risk Warning” messages:

-

Conduct transactions in a secure environment: Make sure you are trading in a secure and private environment to prevent others from accessing or stealing your sensitive information.

-

Keep your passwords private: Never share your account password or other sensitive information with anyone. This is essential to secure your account and prevent unauthorized access.

-

Do not use third-party payments: Only use your own credit card or the payment methods that match your Identity Verification on Bybit.

-

Ensure you have available funds: Make sure that you have sufficient funds in your account for any payments or on-platform transactions.

-

Maintain good trading behavior: Ensure that you are following our Terms of User Service and best practices for safe and responsible trading. Avoid unusual or high-risk trading patterns that may trigger risk warnings.

For more details, visit our Help Center to view the respective Terms & Conditions.

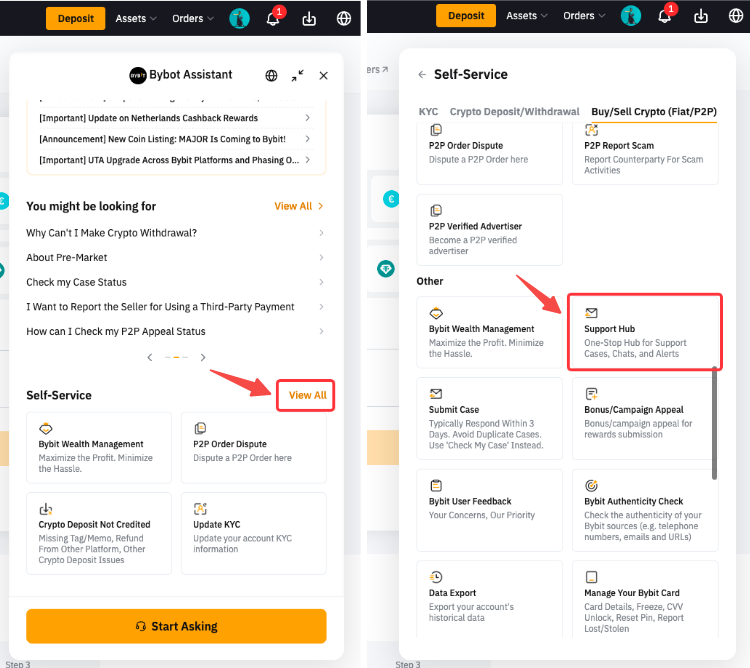

What should I do if I receive a message asking for more information or a Risk Warning pop-up message?

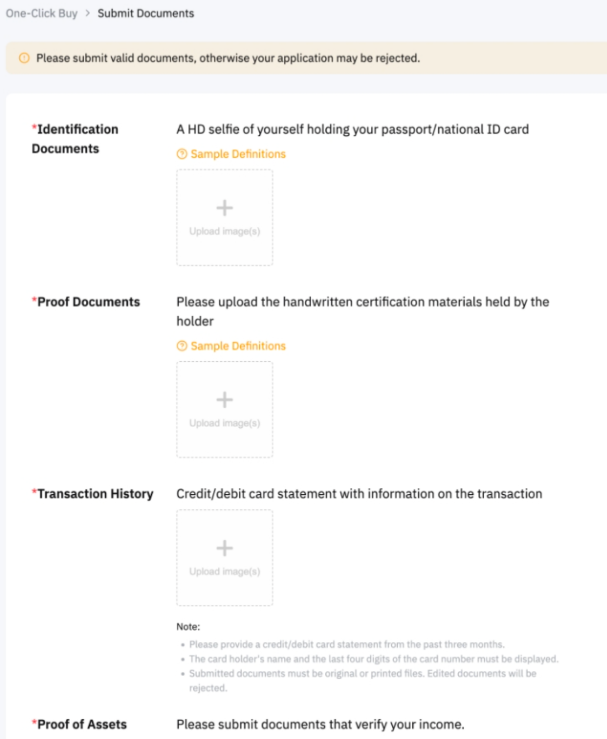

If you receive a message asking for more information or encounter a Risk Warning pop-up message, please click on Submit. You will be redirected to a page where you can submit the requested documents. Alternatively, you can also find the submission tickets in the Support Hub.

Please note that the requested documents may vary between individuals. You may click on Sample Definitions under the document description to find out more about the requirements.

Document Submission Related

I received both an email and a push notification requesting additional information, where can I locate the portal for submitting the requested documents?

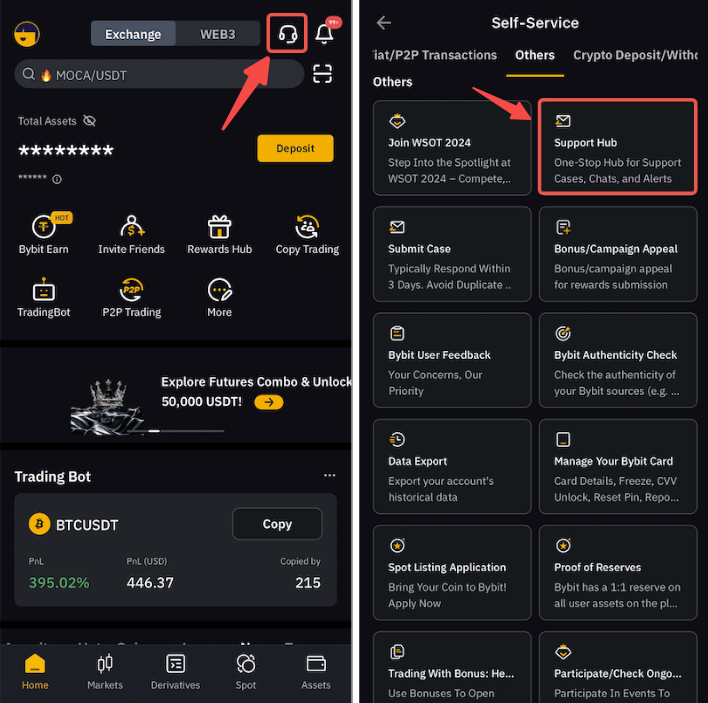

In addition to the direct link provided in the notification channels, you can also find the Support Hub submission portal at the Live Chat entrance.

|

On the App |

On the Website |

|

|

|

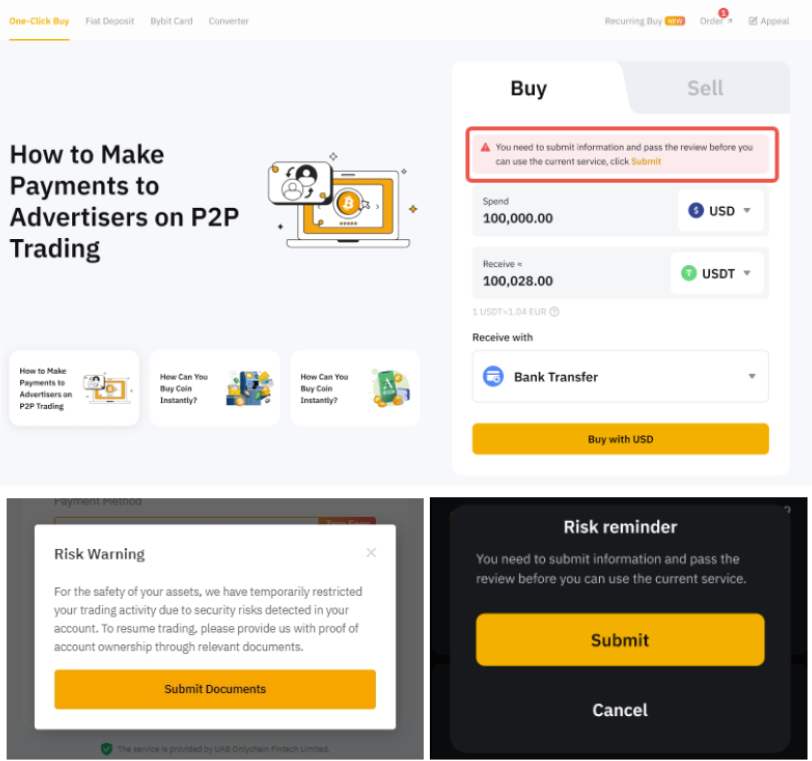

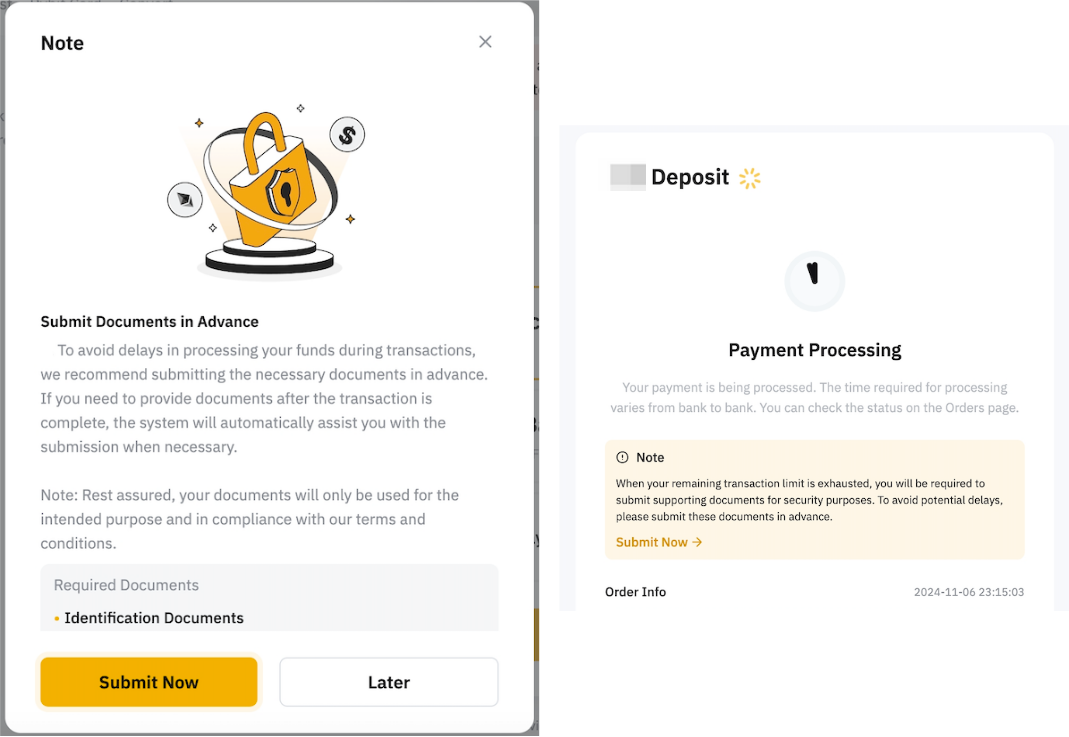

Why was I prompted to pre-submit documents even though I haven't reached the limit?

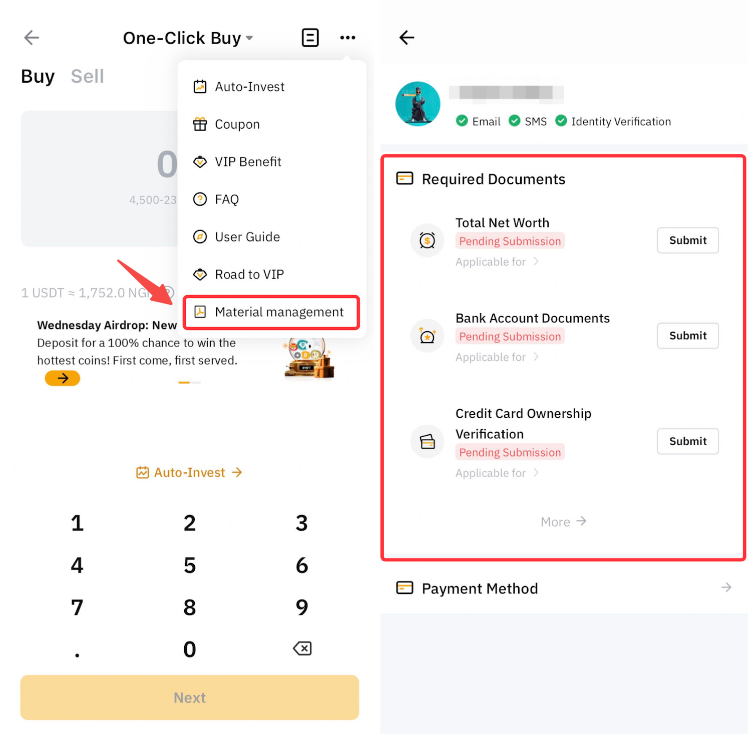

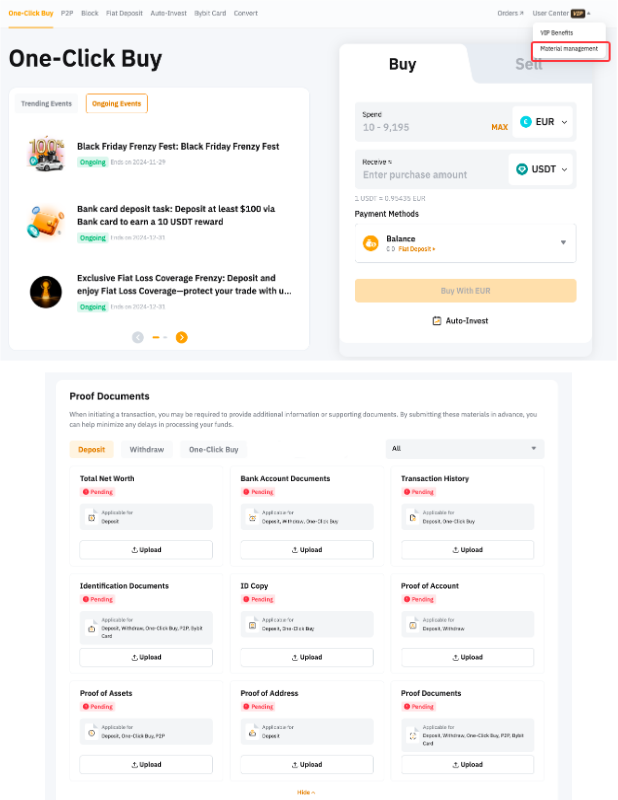

We have designed a collection point for you to pre-submit the required documents. This function helps prevent delays in fund transfers or other impacts on your transaction process due to third-party requirements such as service providers or banking procedures. We recommend that you submit relevant documents in advance through the submission portal by going to the One-Click Buy or Fiat Deposit page → User Center → Materials Management.

|

On the App |

On the Website |

|  |

Once submitted, the system will automatically assist you in submitting these documents when necessary, ensuring minimal disruption to your transactions.

Will submitting documents in advance reduce the need to provide them again in the future?

In some cases, submitting documents in advance may reduce the need for you to provide information in the future, but it doesn't necessarily mean that you will never need to submit documents again. Each document has a valid period. Please refer to the table below for the validity period of each document.

|

Material Types |

Valid Period (Days) |

|

Proof of funds |

30 |

|

Selfie with passport/ID card in hand |

90 |

|

Ordinary selfie |

90 |

|

Bank statement |

90 |

|

Credit card bill |

90 |

|

Copy of passport/ID card |

90 |

|

Proof of credit card ownership |

90 |

|

Proof of residence (within 3 months) |

90 |

|

Account balance statement |

90 |

|

Proof of deposit account ownership |

Permanent |

If I submitted one of the pieces of information in Scenario A (One-Click Buy, Fiat Deposit, Fiat Withdrawal, P2P, and Bybit Card), can it be used in another scenario?

Yes, as long as the document is valid, it can be used in multiple scenarios. You can consult the table below to see which materials can be used in each scenario.

|

Material Types |

Applicable Scenarios | ||||

|

One-Click Buy |

Fiat Deposit |

Fiat Withdrawal |

P2P |

Bybit Card | |

|

Proof of funds |

✓ |

✓ |

X |

✓ |

✕ |

|

Selfie with passport/ID card in hand |

✓ |

✓ |

✓ |

✓ |

✓ |

|

Ordinary selfie |

✓ |

✓ |

✓ |

✓ |

✓ |

|

Bank statement |

✓ |

✓ |

✓ |

✕ |

✕ |

|

Credit card bill |

✓ |

✓ |

✕ |

✕ |

✕ |

|

Copy of passport/ID card |

✓ |

✓ |

✕ |

✕ |

✕ |

|

Proof of credit card ownership |

✓ |

✕ |

✕ |

✕ |

✕ |

|

Proof of residence (within 3 months) |

✕ |

✓ |

✕ |

✕ |

✕ |

|

Account balance |

✕ |

✓ |

✕ |

✕ |

✕ |

|

Account proof |

✕ |

✓ |

✓ |

✕ |

✕ |

What is the accepted document format?

-

We only support PNG, PDF, JPG, and JPEG file formats that are not larger than 10 MB.

-

We can only accept a maximum of five (5) documents per request.

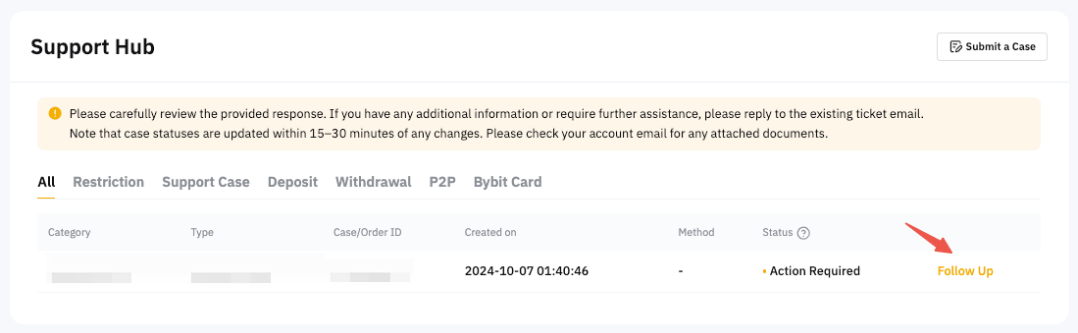

When can I expect a result or outcome?

After you have submitted the requested documents, the relevant team will review your case within 48 hours. You will receive the outcome through your registered email.