Chase Limit Order is a limit order placed at the best bid or ask that dynamically adjusts its entry price to match changing market conditions until the order is filled, canceled, or reaches a maximum chase distance.

Chase Limit Order is more effective for traders seeking to execute big orders as limit orders while minimizing waiting time and potential slippage. These are some advantages of using Chase Limit Order:

- Swift Execution: Chase Limit Order allows traders to swiftly enter the market in maker order, minimizing the time spent waiting for favorable price levels.

- Reduced Slippage: Chase Limit Order helps mitigate the risk of slippage and approaches desired entry price as much as possible by dynamically tracking the best ask/bid.

- Arbitrage Opportunities: Chase Limit Orders create potential arbitrage chances by closely tracking market movements, enabling traders to profit from price disparities between markets or trading pairs.

Currently, the Chase Limit Order is available for Inverse Contracts, USDT Perpetuals, USDC Perpetuals, and USDC Futures on Bybit.

How Does Chase Limit Order Work?

With Chase Limit Order, traders can set the Chase Price at Ask1/Bid1 or define a fixed distance from Ask1/Bid1. The distance, represented in price or ratio, is to be maintained between the Ask1/Bid1 and the Order Price. The platform then continuously adjusts the Chase Price to ensure the preset Chase Price is maintained until the order is either filled, canceled, or reaches the maximum chasing distance.

A Maximum Chase Distance can be set in value or percentage. Once the Maximum Chase Distance is reached, the order will stop chasing the market and remain at the current price.

There are a few scenarios where traders can explore the flexibility of a Chase Limit Order.

Scenario 1: Chase Ask1/Bid1

In the scenario of Chase Ask1/Bid1, traders are not bound by predefined conditions such as maximum chasing distance. Instead, the order will persistently track the market price, adjusting as it moves until the order is either successfully filled or canceled.

Here is an example. Let’s say a trader places a long Chase Limit Order with a quantity of 20,000 XCN at the current Bid1 price of 0.00123 USDT. Upon order placement, the market price and Bid1 price shift to 0.00124 USDT, the limit price of the Chase Limit Order is then updated to 0.00124 USDT to match the new Bid1 price and await execution.

If the trader sets the maximum chasing distance to 0.00005 USDT, and the maximum chasing price to 0.00128 USDT, the changes in Limit Price are as follows:

|

XCN/USDT |

Initial Entry |

LTP ↑ |

LTP ↑ |

|

Last Traded Price (LTP) |

0.00123 |

0.00127 |

0.00131 |

|

Bid1 Price |

0.00123 |

0.00127 |

0.00131 |

|

Distance from Bid1 |

0 |

0.00004<Max Chasing Distance |

0.00008>Max Chase Distance |

|

Limit Price |

0.00123 |

0.00127 |

0.00128 |

Scenario 2: Chase Distance From Ask1/Bid1

Traders are also able to place a Chase Limit Order at a fixed distance, in price or ratio, from Ask1/Bid1. When the market price and limit price converge, the Chase Limit Order remains the same. However, if the gap between them widens, indicating a less favorable price, the limit price will be adjusted to a new price point at the predefined distance from Ask1/Bid1.

For example, a trader places a long Chase Limit Order of 1,000 XCN with a Chase Distance of 2.5% of the market price. The market price at the time of order placement is 0.00120. A limit order will be placed with an order price of 0.00120 USDT*(100%-2.5%)=0.00117 USDT.

The table below illustrates how the Chase Limit Order price adjusts as the market price fluctuates to find the best ask/bid price within the predefined distance.

|

XCN/USDT |

Initial Entry |

If LTP ↓ |

If LTP ↑ |

|

Last Traded Price (LTP) |

0.00120 |

0.00119 |

0.00125 |

|

Bid1 Price |

0.00120 |

0.00119 |

0.00125 |

|

Chase Distance (ratio) |

2.5% |

2.5% |

2.5% |

|

Price Gap |

0.00003 |

0.00002975 |

0.00003175 |

|

Limit Price |

0.00117 |

0.00117 (unchanged) |

0.00122 (chase distance maintained) |

Notes:

— Each trader can place one Chase Limit Order, either long or short, per trading pair. The maximum number of open Chase Limit Orders allowed per UID is five (5).

— The minimum Chase Distance is 0.01%, and the maximum Chase Distance is 10% of the LTP, with a precision of up to two decimals.

— All Chase Limit Orders are by default Post only orders to ensure execution as maker order. In cases of significant market volatility, if your order is rejected five times due to the post-only condition, the strategy will be canceled.

How to Place a Chase Limit Order

Step 1: Log into your Bybit account and visit the Derivatives trading page.

Step 2: Select the contract you wish to trade.

Step 3: On the Bybit website, click the Tools tab, and select Chase Limit Orders.

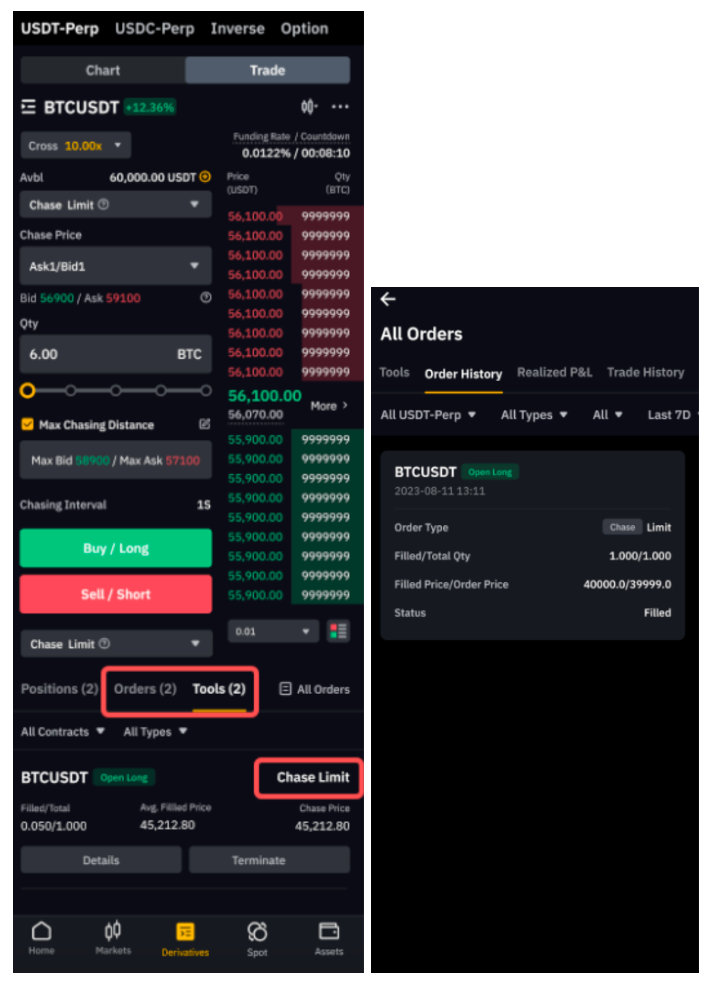

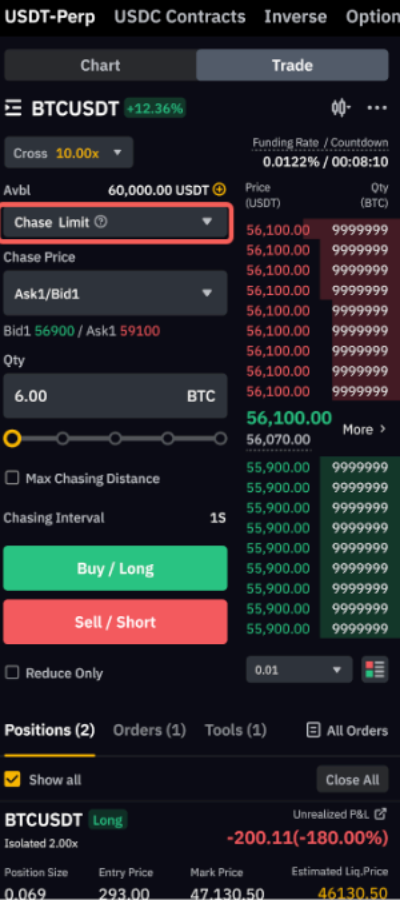

On the Bybit App, go to the Derivatives page, tap on the dropdown list of Order Types, and select Chase Limit Orders.

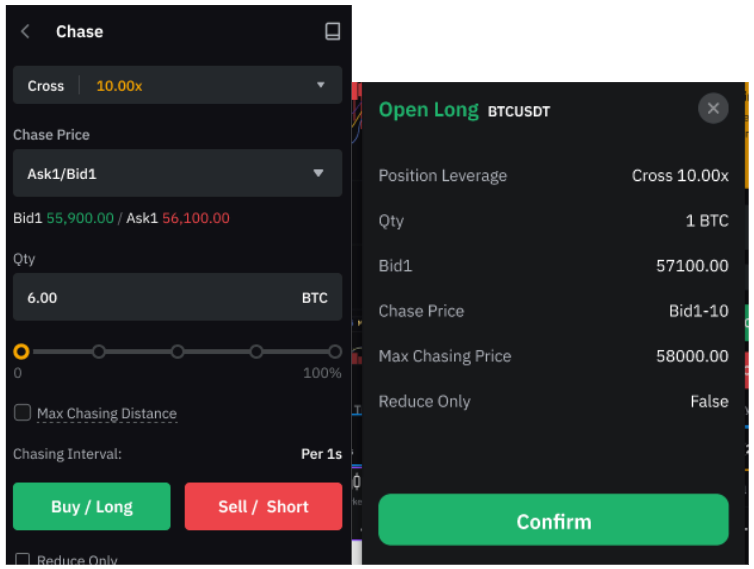

Step 4: Select your Chase Price and fill in the Order Quantity. Check the Max. Chasing Distance box and enter the maximum distance or percentage, if required. Currently, the Chase Interval is set at one second.

Please ensure that your account has a sufficient balance to successfully place your order.

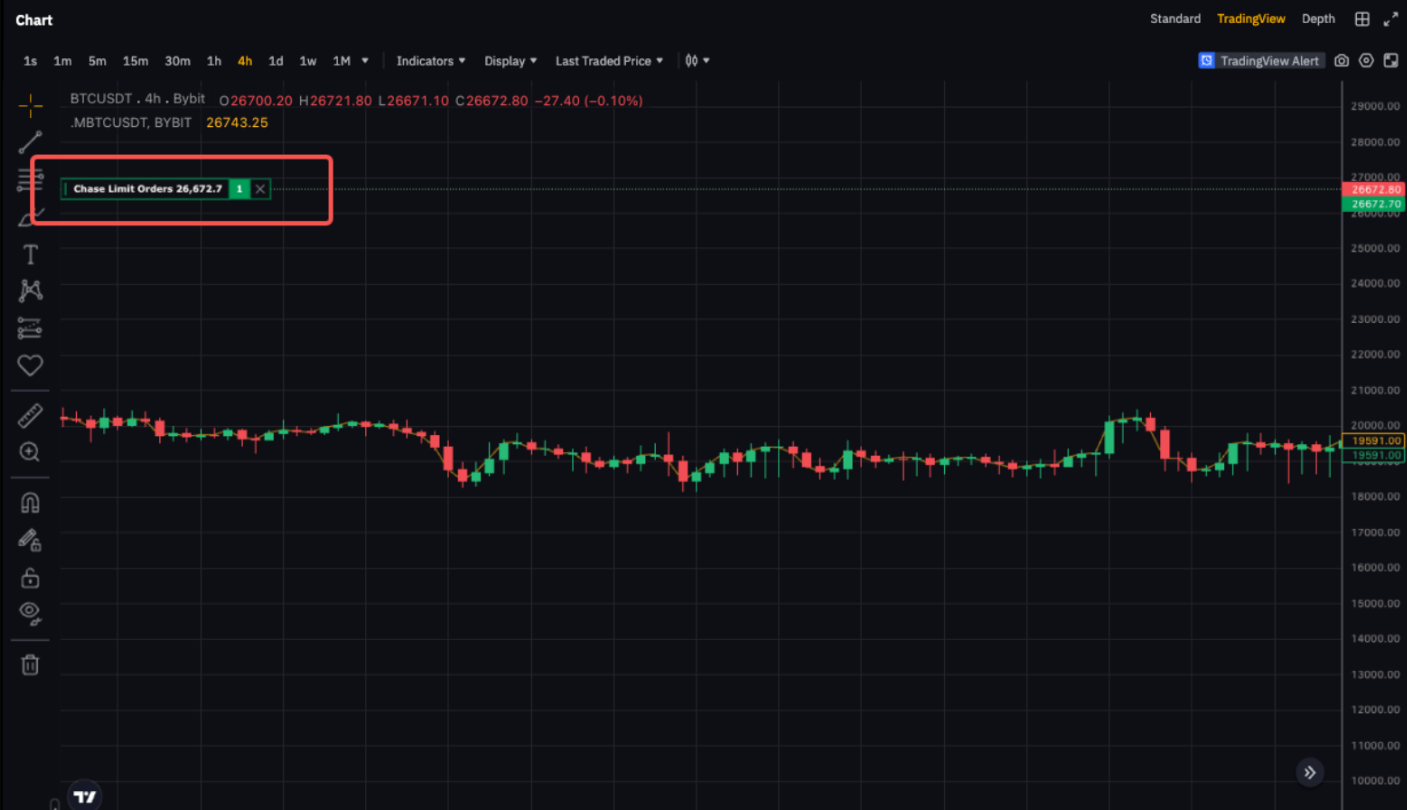

Once submitted, the order placed will be labeled as Chase Limit Orders on the Chart to differentiate it from other limit or market orders.

How to View Your Chase Limit Orders

Via Desktop

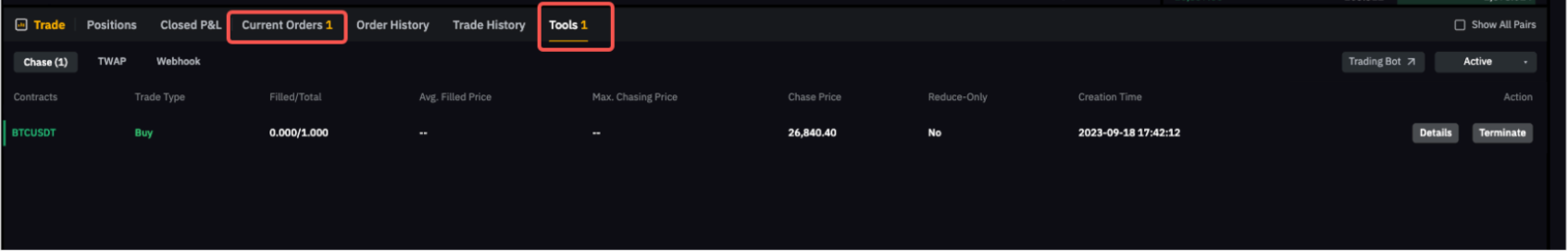

Once the Chase Limit Order is placed, you will be able to see the Chase Limit Order under the Current Orders and Tools tab.

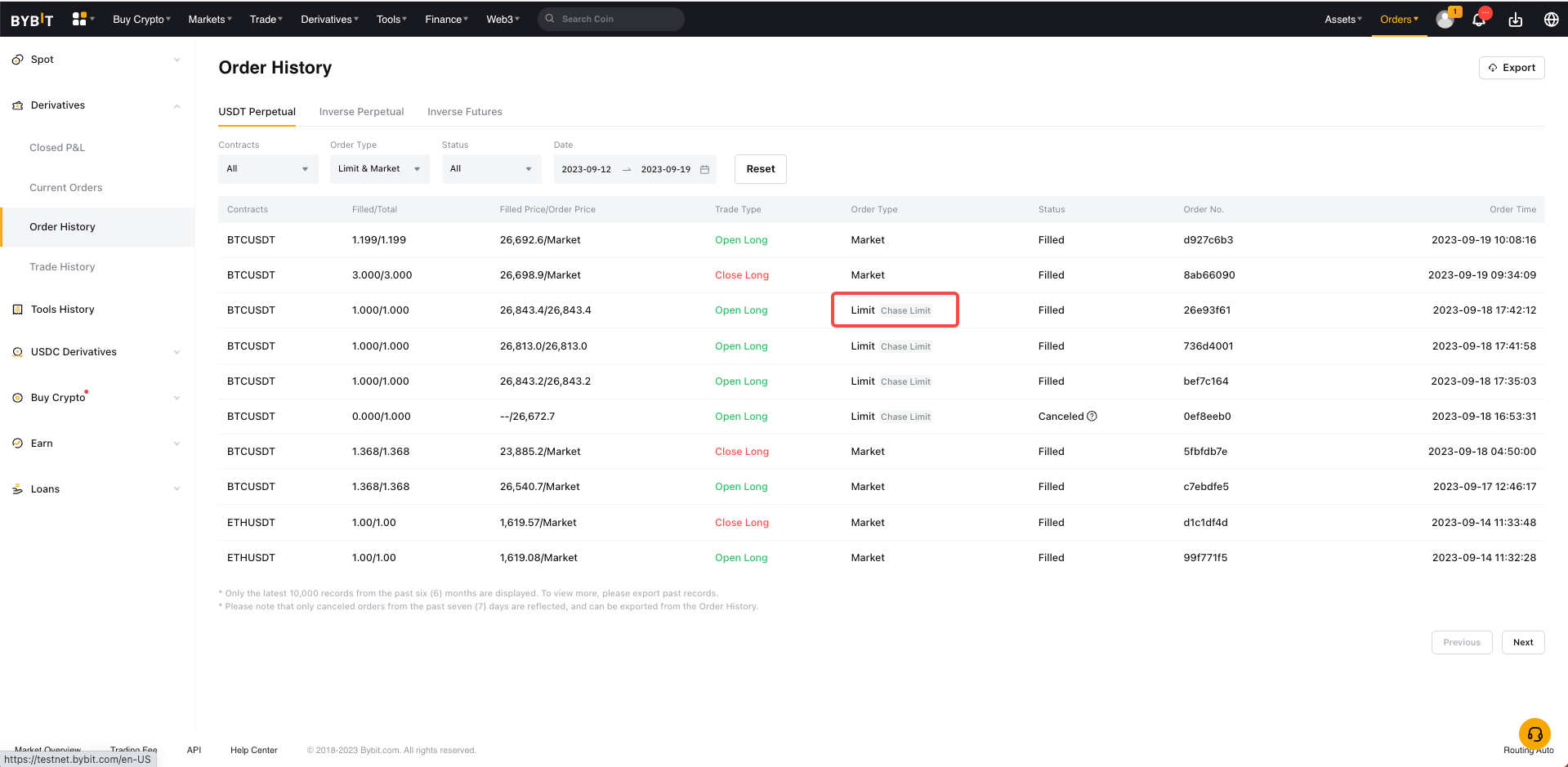

After the order is executed or canceled, you can view the details from the Order History page, with a Chase Limit label.

Via App

Select Orders or Tools tab to view your current Chase Limit Orders. To view the executed or canceled Chase Limit Orders, go to Order History, and you will see the Chase Limit Orders with a Chase label.