What is a Unified Trading Account (UTA)?

Bybit's Unified Trading Account (UTA) centralizes spot, futures, and options trading into a single account, simplifying the trading experience. Supporting over 70 cryptocurrencies as collateral, this account-level margin system allows unrealized profits to be used as margin for trading different product types. The UTA features three margin modes—Isolated, Cross, and Portfolio Margin—each catering to different risk preferences and trading strategies, thus optimizing risk management and trading flexibility.

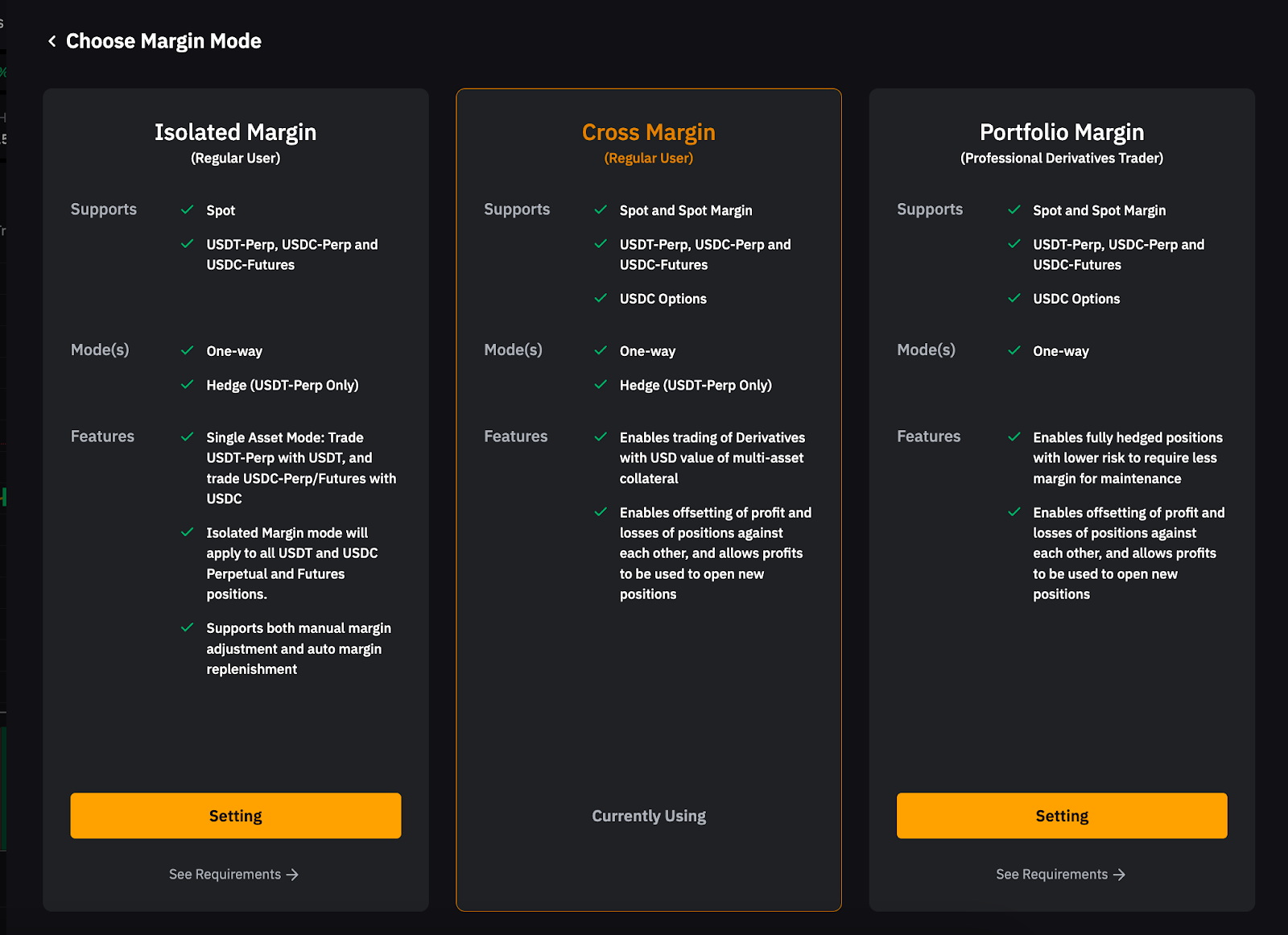

Margin Modes Supported in UTA

In both Cross Margin and Portfolio Margin modes, the UTA leverages the entire asset value of the account, including unrealized profits, to maintain and initiate derivative positions. This method enhances capital efficiency by allowing profits and losses from different derivatives to offset each other and by calculating margins at the account level rather than per position.

Additionally, for traders who prefer a trading setup similar to the Standard Account, Isolated Margin mode is available. This mode allows traders to segregate margins for individual positions, thereby limiting potential trading losses to the amounts specifically allocated per position.

The below table shows the various account margin modes supported by UTA.

|

Account Margin Mode |

Benefits |

Assets Mode |

Supported Products |

|

Isolated Mode |

Individual margin calculations for positions. Active orders in one position do not impact others, minimizing potential loss to the margin of that specific position. |

Single Asset Mode: Each asset, like USDT, is used only for its corresponding contracts, e.g., USDT can only be used for USDT contracts, while USDC is specific to USDC contracts. |

|

|

Cross Margin Mode |

Profits and losses across different products can offset each other, allowing profits to be used to open new positions. |

Multi-Asset Mode: All assets are collateralized as USD for spot margin and derivatives trading. |

|

|

Portfolio Margin Mode |

In addition to Cross Margin benefits, margin requirements are based on the net exposure of the entire portfolio. For more information, please visit here. |

Notes:

— You won’t be able to switch back to your current Spot and Derivatives Account after the upgrade.

— To learn more about the difference between the Isolated Margin, Cross Margin, and Portfolio Margin modes under the Unified Trading Account, please visit here.

Auto Borrowing / Auto Repayment

If the equity of an asset under the Unified Trading Account falls below zero due to trades and/or unrealized losses, the system will automatically process the borrowing of the asset. Similarly, any unrealized profits from the borrowed asset will offset the borrowed amount. Additionally, any deposits or realized profits will automatically be processed as repayment. For more information, please refer to the Borrowing and Repayment (Unified Trading Account).

Collateral Value Ratio

Under Cross Margin and Portfolio Margin modes, the margin calculations depend on the adjusted equity value of the account. Each collateral asset is valued according to its specific collateral value ratio. This ratio primarily reflects the liquidity conditions of the asset.

The total margin balance in USD value of your Unified Trading Account is based on the following calculation:

Total Asset Value (in USD) = Sum (Asset 1 × Corresponding USD Index Price × Corresponding Collateral Value Ratio + Asset 2 × Corresponding USD Index Price × Corresponding Collateral Value Ratio + …. + Asset N × Corresponding USD Index Price × Corresponding Collateral Value Ratio)

The USD Index Price can be derived as follows:

USD Index Price = USDT Perpetual Index Price x USDT Conversion Rate

USDT Conversion Rate = BTCUSD Index Price / BTCUSDT Index Price

In the event that there is no USDT Perpetual Index Price for a certain asset, the Last Traded Price from Bybit Spot market will be taken as a reference. Take ETH as an example; the USD index price for ETH will be ETHUSDT Index Price x USDT Conversion Rate.

|

Asset |

Collateral Value Ratio |

|

USDC |

100% |

|

USDT |

100% |

|

BTC |

95% |

|

ETH |

95% |

To learn more about the collateral value ratio of different assets, visit this page.

Notes:

— The collateral value ratio only applies to assets with a positive balance. For assets with a negative balance, the collateral value ratio will default to 100%.

— Parameters may be modified based on market conditions. Bybit will notify users in advance.

— Traders can customize the collateral assets that they want to serve as the margin assets. For more details, please refer to How to Customize The Collateral Assets Settings.

Example

Assuming Trader A currently has 1,000 USDT, 1,000 USDC, and 0.1 BTC in their Unified Trading Account.

|

Assets |

USD Index price |

Collateral Value Ratio |

USD equivalent |

|

USDT |

0.9952 USD |

100% |

1,000 x 0.9952 x 100% = 995.20 USD |

|

USDC |

1 USD |

100% |

1,000 x 1 x 100% = 1,000 USD |

|

BTC |

16,639.81 USD |

95% |

0.1 x 16,639.81 x 95% ≈ 1,580.7819 USD |

|

Total Margin Balance = 995.20 + 1,000 + 1,580.7819 ≈ 3575.9819 USD The total amount that can be used as a margin in your account is 3575.9819 USD. | |||

Risk Management

Under Cross and Portfolio Margin modes, the UTA calculates all risks and assets in USD. Positions can be maintained as long as the account's maintenance margin rate is below 100%. Liquidation is triggered when maintenance margin rate reaches or exceeds 100%.

Under Isolated Margin mode, the UTA segregates the margin used for an individual position from the account balance. Liquidation is triggered when the Mark Price reaches or exceeds Liquidation Price.

For additional details on margin and liquidation policies, refer to Trading Rules: Liquidation Process (Unified Trading Account).

API Management

Under the UTA, API V5 provides enhanced capabilities for users upgrading from the Standard Account. The interface remains largely unchanged in terms of input parameters and JSON returns, ensuring a seamless transition. Key improvements include streamlined endpoint names to reduce development efforts required to trade across different product types. For additional details API V5, refer to Introduction to API V5.

Below is a comparison of commonly used REST endpoints between the Standard Account (V3) and UTA (V5):

|

|

V3 (Standard Account) |

V5 (UTA and Standard Account) |

|

Order creation |

/unified/v3/private/order/create |

v5/order/create |

|

/contract/v3/private/order/create | ||

|

Order amendment |

/unified/v3/private/order/replace |

/v5/order/amend |

|

/contract/v3/private/order/replace | ||

|

Order deletion |

/unified/v3/private/order/cancel |

/v5/order/cancel |

|

/contract/v3/private/order/cancel | ||

|

Show positions |

/unified/v3/private/position/list |

/v5/position/list |

|

/contract/v3/private/position/list | ||

|

Show wallet |

/unified/v3/private/account/wallet/balance |

/v5/account/wallet-balance |

|

/contract/v3/private/account/wallet/balance |

Users can manually upgrade to the Unified Trading Account via the PC trading site or Bybit App. To learn more about how to get started with a Unified Trading Account, please visit here.

Read More

Bybit Unified Trading Account: Who Is It Best Suited For?

7 Key Benefits of Upgrading to Bybit Unified Trading Account

How to Use the Bybit Unified Trading Account for Effective Risk Management