Crypto Loans is an overcollateralized loan service designed to meet your liquidity needs. It offers both flexible and fixed rate loans at competitive interest rates. By using your crypto as collateral, you can borrow funds without selling your holdings, which is ideal if you believe your assets will appreciate over time and prefer to hold them long-term.

Place an Order

Step 1: Log in to the Bybit website and click on Finance → Crypto Loans in the navigation bar to access the Crypto Loans page.

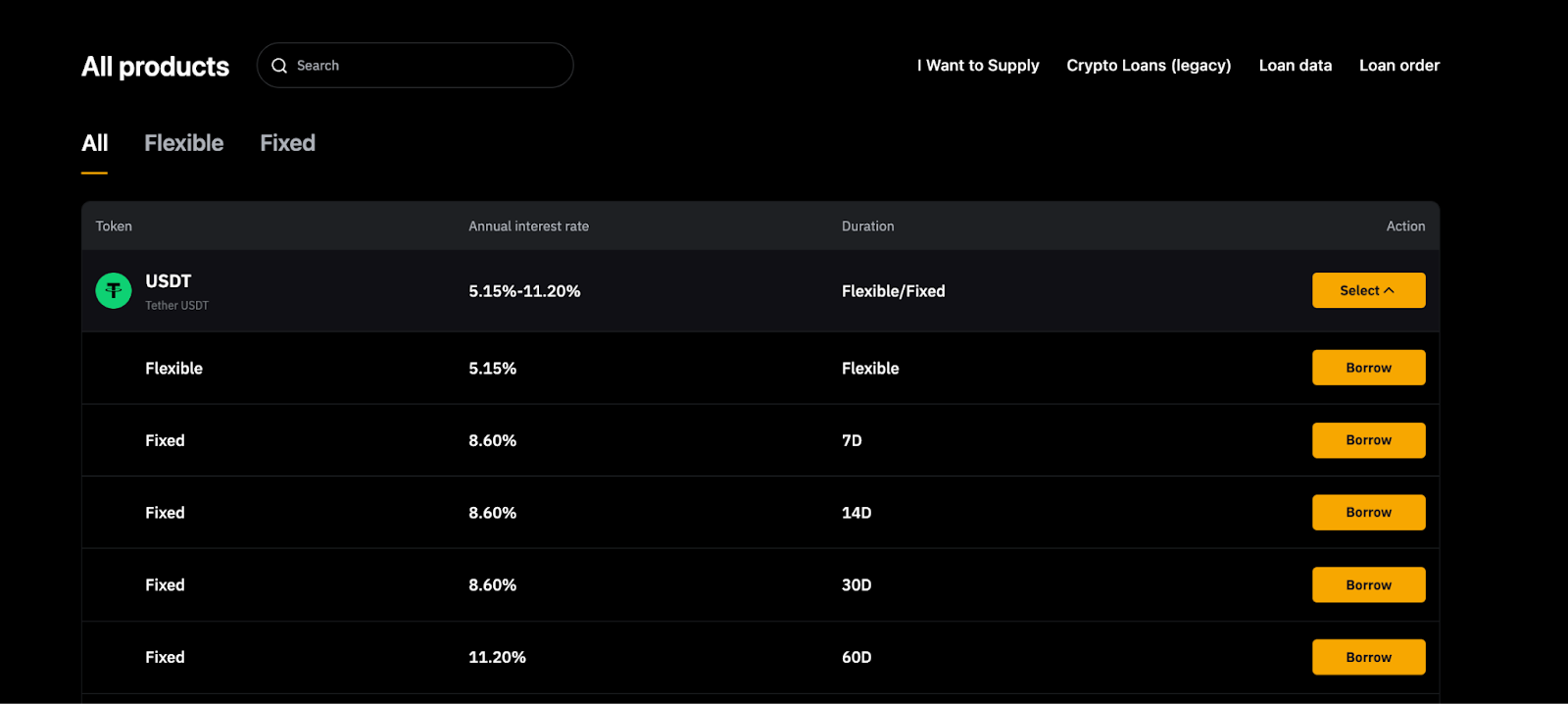

Step 2: Under All products, you'll find both flexible and fixed rate loan options. Select or search for the asset you wish to borrow to view the available durations and corresponding interest rates. Click Borrow on the option that suits you.

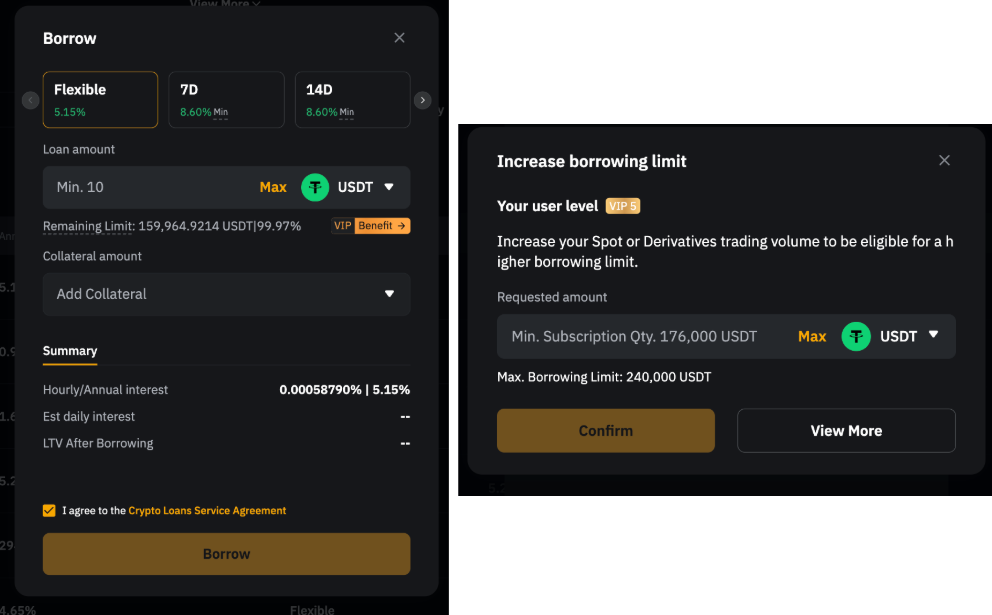

a) For a flexible rate loan:

The Flexible rate loan popup will appear. Specify the following details and click Borrow again:

-

Recommendation bar: At the top, you'll find the best interest rate currently available in the market.

-

Loan amount: Click Max to borrow the maximum amount allowed based on your collateral value and the asset's borrowing cap.

-

VIP Benefit: For VIP users, you can increase the borrowing limit by clicking on VIP Benefit.

-

Collateral amount: Collateral asset and amount

Your LTV after borrowing, hourly/annual interest rate and estimated daily interest will be calculated automatically.

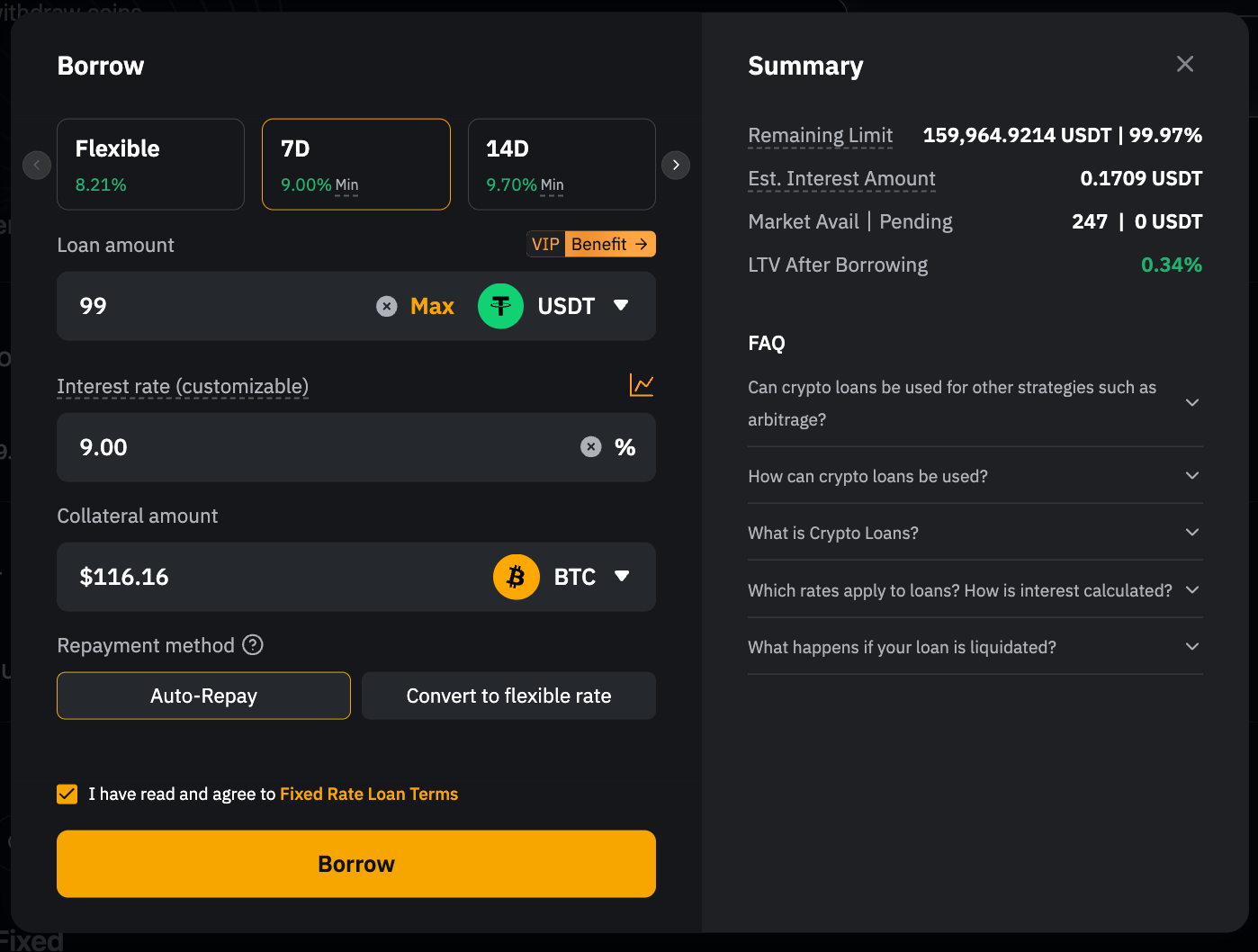

b) For a fixed rate loan to borrow funds:

The Fixed rate loan popup will appear. Specify the following details and click Borrow again:

-

Recommendation bar: At the top, you'll find the best interest rate currently available in the market, along with a fixed-duration option.

-

Loan amount: Enter the amount you wish to borrow.

-

VIP Benefit: For VIP users, you can increase the borrowing limit by clicking on VIP Benefit.

-

Interest rate: Specify your expected interest rate.

-

Collateral amount: Select the supported collateral asset(s) available in your Funding Account.

-

Repayment Method:

-

Auto-Repay: Enable this option to automatically use assets in your Funding Account to repay the loan on the settlement date.

-

Convert to Flexible Rate: Enable this option to convert your fixed-rate loan into a flexible-rate loan automatically once it reaches maturity.

-

Once done, click Borrow, and a confirmation pop-up will appear.

Notes:

— Interest is charged upfront. Once a borrow order is matched, the borrowed assets, minus the interest, will be credited to the borrower's Funding Account. Loans can be repaid at any time, but prepaid interest is non-refundable.

— If the loan is overdue, a penalty of three times the interest will automatically apply, accruing hourly during the grace period following the expiry date. If the loan remains unpaid by the end of this period, the collateral will be automatically liquidated to cover the loan and overdue interest. A liquidation fee of 2% of the loan amount will also be charged. If your collateral is converted to repay the loan, a 0.1% exchange fee will apply to the conversion.

— A single borrow order can be matched with multiple supply orders. If the matches occur at different times, the borrow order will have multiple settlement dates.

— The LTV is calculated based on Cross Margin mode, where collateral assets are used across all loan orders. The Initial LTV is set at 80%, meaning the total value of your borrowed assets and interest cannot exceed 80% of your collateral's value (with the collateral value ratio applied).

Now your Crypto Loans order has been successfully placed!

View Your Orders

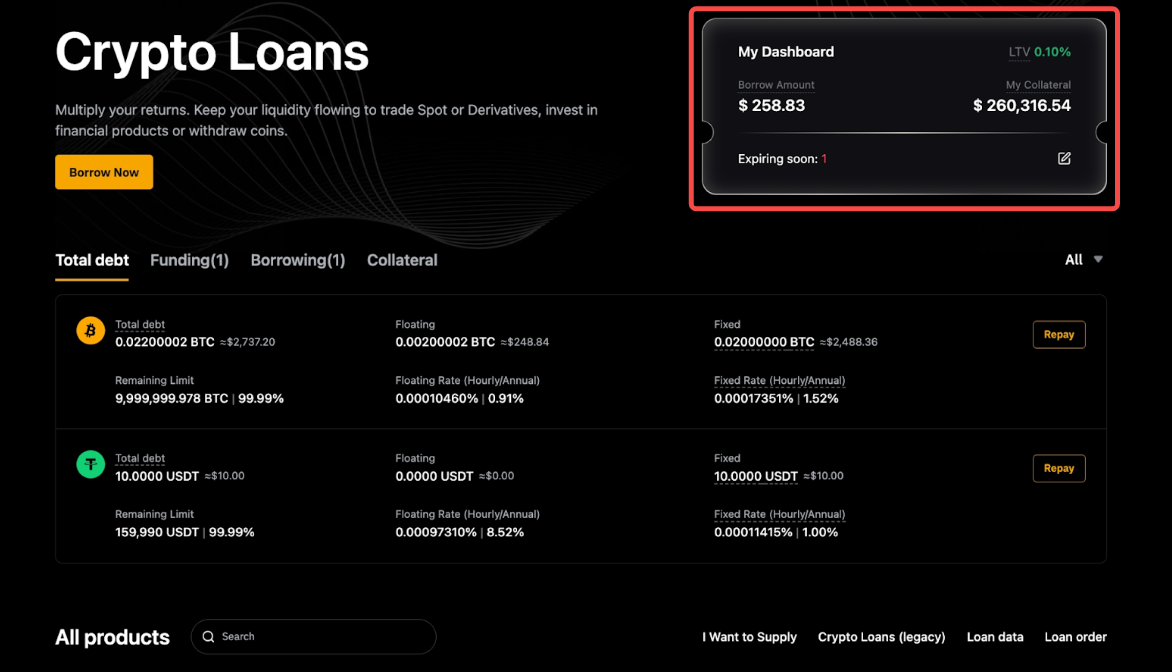

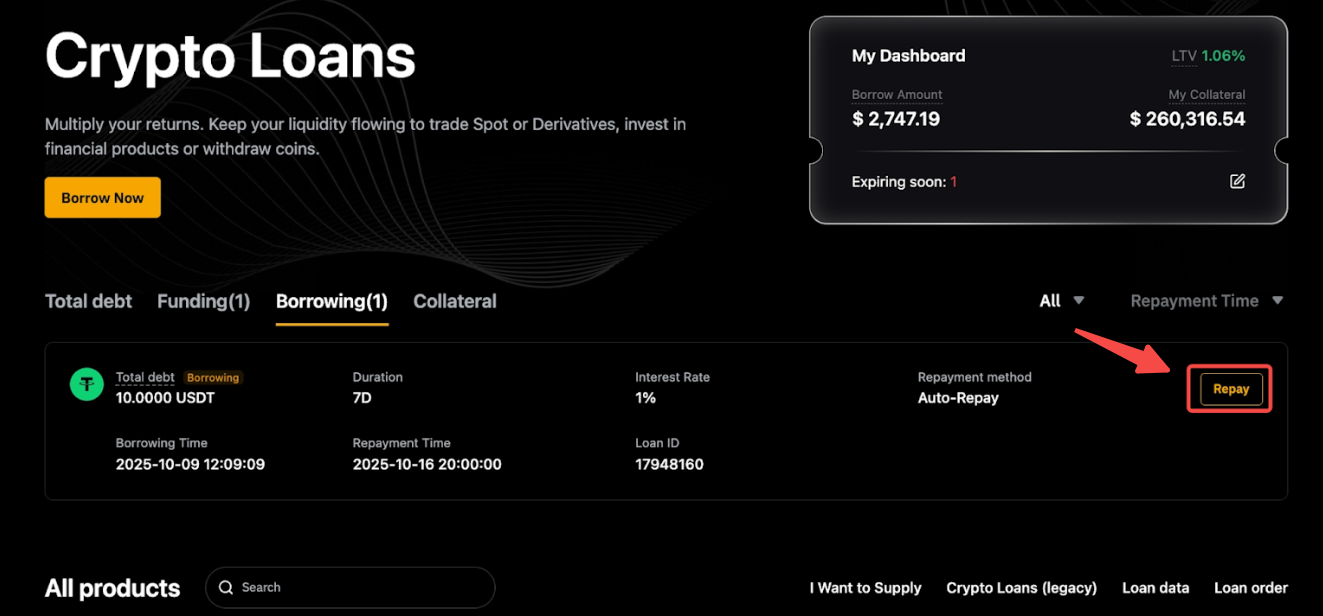

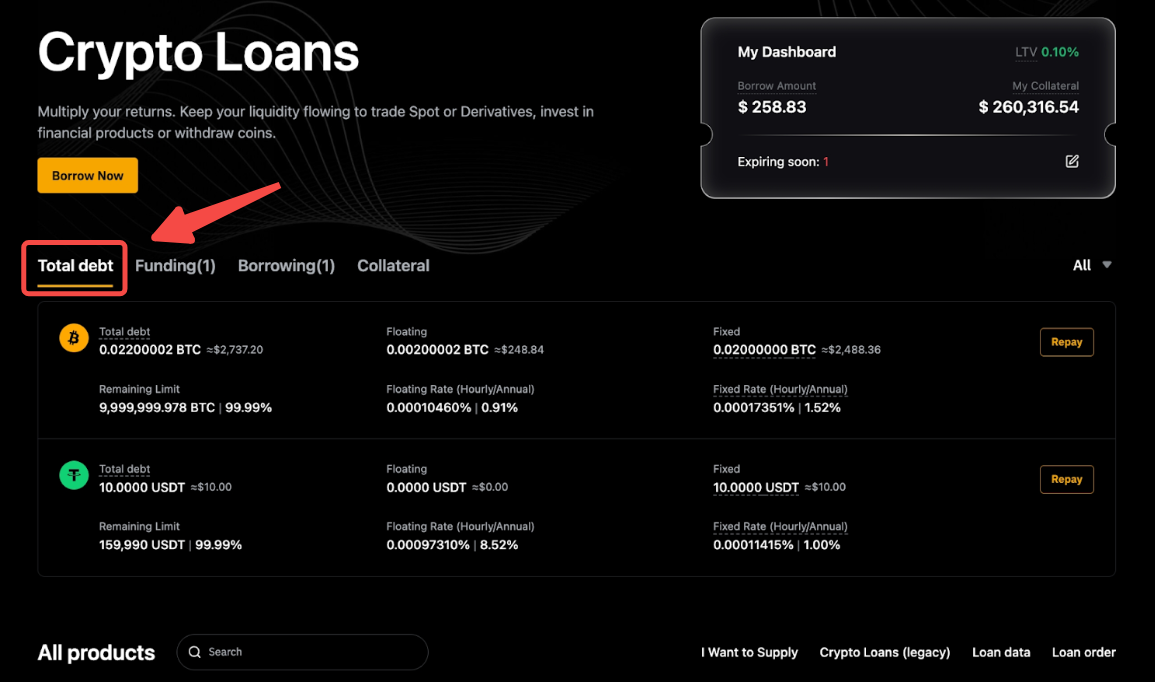

To check your loans, go to the Crypto Loans homepage and you'll see an overview of your total borrowings, collateral and orders.

On the overview dashboard, all the details are organized under Total Debt, Funding, Borrowing and Collateral:

-

Total Debt — Shows all assets borrowed and information under the Flexible and Fixed Rate Loan. The floating value is only displayed for Flexible Loan whereas fixed value is only displayed for Fixed Rate Loan.

-

Funding — Loan orders that are currently in the matching process, which is not yet fully executed but remains active until the matching is complete.

-

Borrowing — Loan orders that have already been placed and active.

-

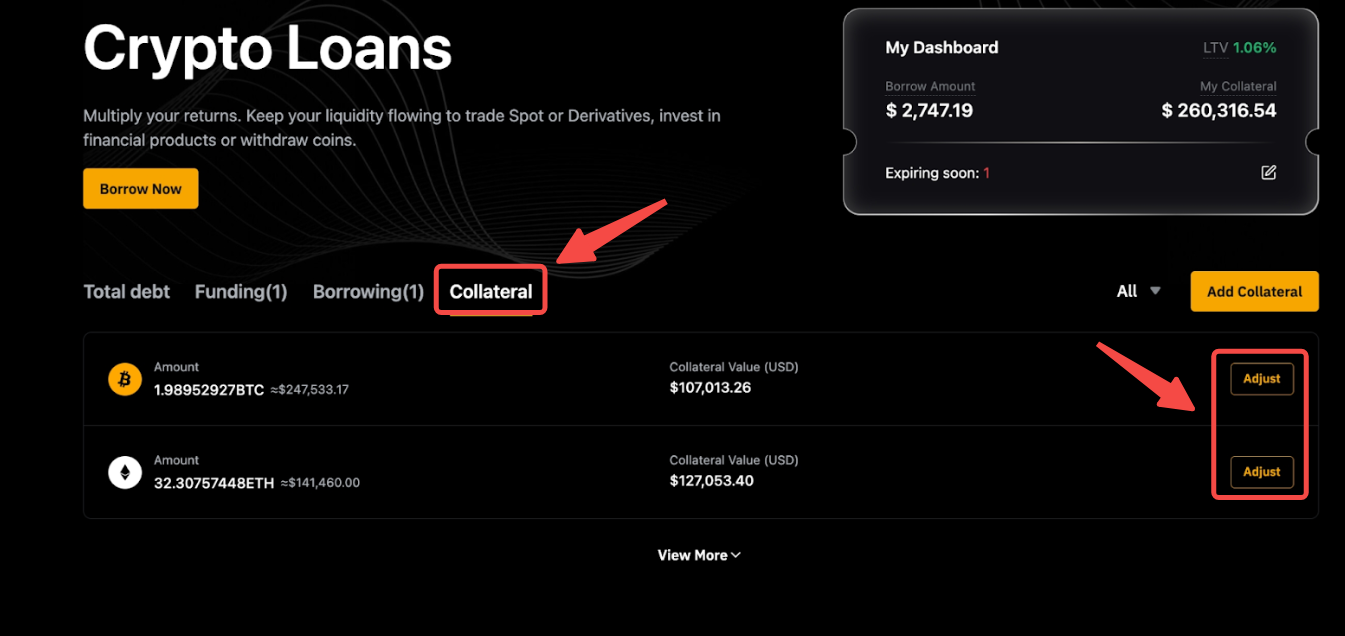

Collateral: Lists all collateral assets with their quantity and USD value. Click Adjust to modify your collateral.

To view a complete list of all your orders, click Loan order under the Overview Dashboard. You can see all the Crypto Loans orders by switching the product tabs on top, including the Flexible-Rate Loan, Borrow (Fixed) and Flexible Rate Loan (Legacy), with detailed information on your loan, repayments, interest, collateral and more. You can also filter by asset or time to narrow down the results.

Repay Your Loan

Step 1: From the Overview Dashboard, locate the loan you'd like to repay, and click Repay.

Alternatively, you can make repayments directly from the Orders page.

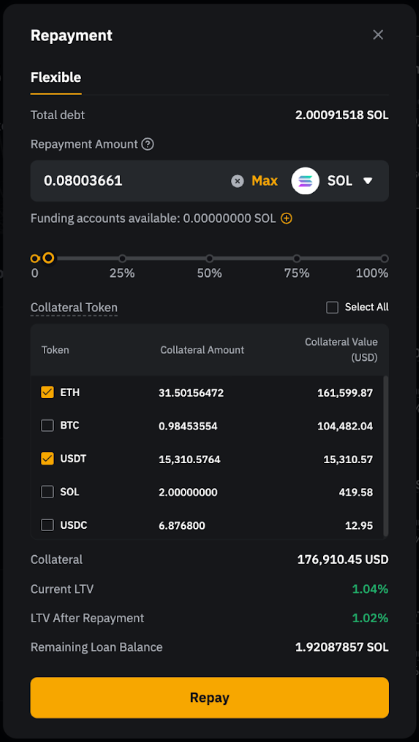

Step 2: Review the repayment details on the confirmation pop-up and click Repay.

Now your loan and interest have been successfully repaid!

Notes:

— Partial repayments are allowed for Flexible Rate Loan and Fixed Rate Loan.

— Loans can be repaid at any time. For Flexible Rate Loan, interest is calculated based on the actual borrowing duration, and any period less than one hour is rounded up to a full hour. For Fixed Rate Loan, the interest is charged upfront when the loan is confirmed and won't be refunded if you repay early.

— If Auto-Repay is enabled for Fixed Rate Loan, assets in your Funding Account will be automatically used to repay the loan on the settlement date, helping you avoid overdue penalties. Make sure your account has enough funds to cover the full repayment; otherwise, the automatic repayment will fail.

— You can also enable a “repayment due” reminder by going to the Crypto Loan homepage and clicking the edit icon next to Expiring Soon in My Dashboard to set the number of days before the due date. Once a repayment is due, the number of expiring products will be displayed next to Expiring Soon.

Adjust Your Collateral

Step 1: From the Overview Dashboard, go to Collateral and click Adjust.

Alternatively, you can add more collateral by clicking Add Collateral in the upper right of Overview Dashboard.

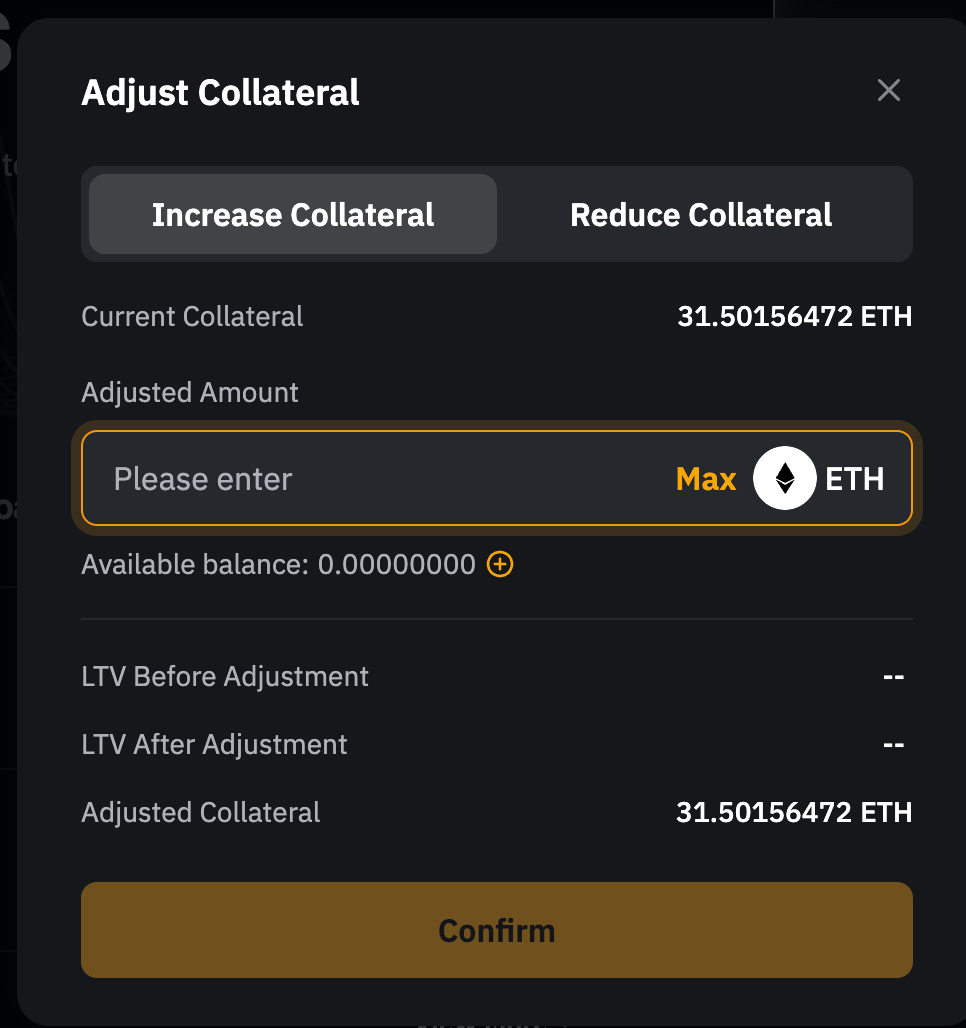

Step 2: To adjust the collateral amount, go to the Increase Collateral tab. Enter the amount you'd like to add, or click Max to use the full available balance in your Funding Account. Adding collateral reduces your LTV and lowers your liquidation risk.

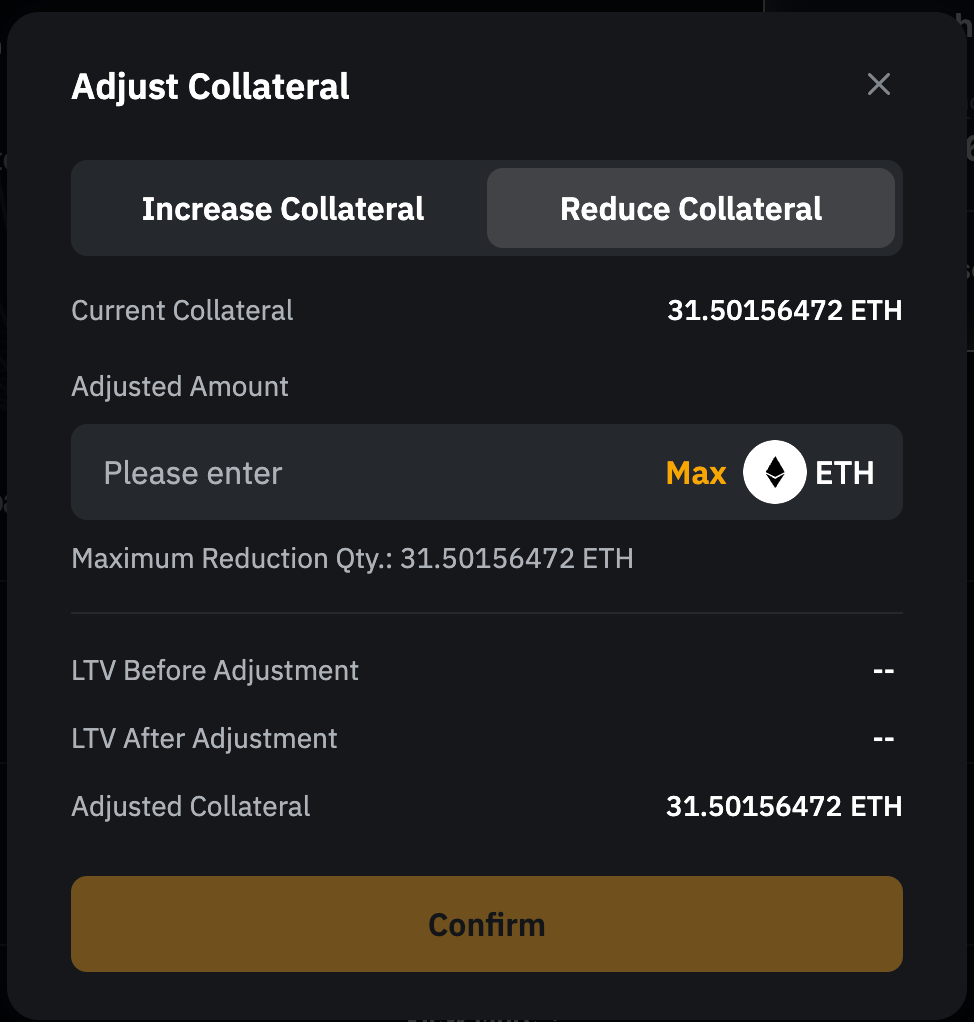

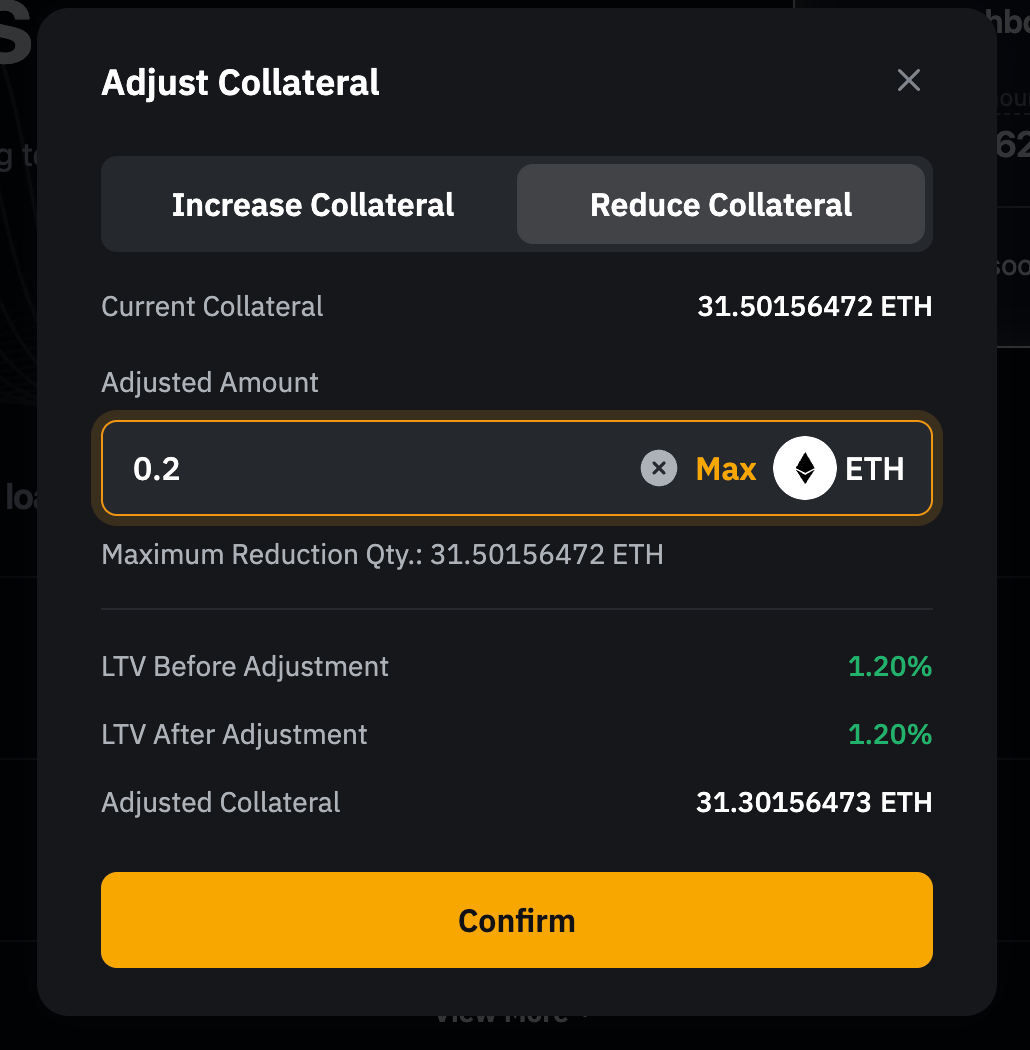

To remove collateral, select the Reduce Collateral tab. Enter the amount you'd like to withdraw, or click Max to remove the Maximum Reduction Qty.

Step 3: Double-check the details and click Confirm.

Notes:

— Collateral can only be reduced if the current LTV is below the Initial LTV.

— The Maximum Reduction Qty refers to the amount that brings your LTV back to its initial level. Please refer to the amount shown in the adjustment window.

Manage Legacy Orders

If you have active orders placed before the launch of the new Crypto Loans, you can manage them by clicking on Total Debt on the Crypto Loan homepage. You'll still be able to make repayments. These orders follow the old LTV rules and won't be included in the new system's calculations. Please note that new loan orders can only be placed in the new Crypto Loans system.

For more information on Crypto Loans, refer to the following articles: